What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Subscribe below to get these insights delivered straight to your inbox:

What's Happening in Energy — July 3

Powered by Halcyon

__

In Michigan, Consumers Energy is reporting on its pilot programs at increasing off-peak EV charging for residential and commercial customers. Without targeted incentives, results are…not great (in Spring 2025, just 497 out of 39,950 EVs in the company’s territory enrolled in its Nighttime Savers plan).

Consumers Energy also justified its proposal to make the pilot programs permanent by arguing that the reduced costs from load management programs would more than pay for themselves by putting downward pressure on rates through optimizing distribution systems.

One other conclusion regards DC fast charging:

One other conclusion regards DC fast charging:

“Our position remains that DCFC infrastructure is highly unlikely to benefit from managed charging other than through technological means (e.g., pairing with battery storage for energy arbitrage in the future as battery prices continue to fall and where make ready costs are higher than average) that do not impact the customer experience.”

__

In Texas, ERCOT’s latest board of directors’ meeting presentation clearly shows that pricing is not sufficient to “support investment in gas peaking generation.”

__

New Jersey is both renaming its plan to procure two gigawatts of battery energy storage and creating three phases for soliciting project proposals. Phase 3 is actually a deferral of itself (see below).

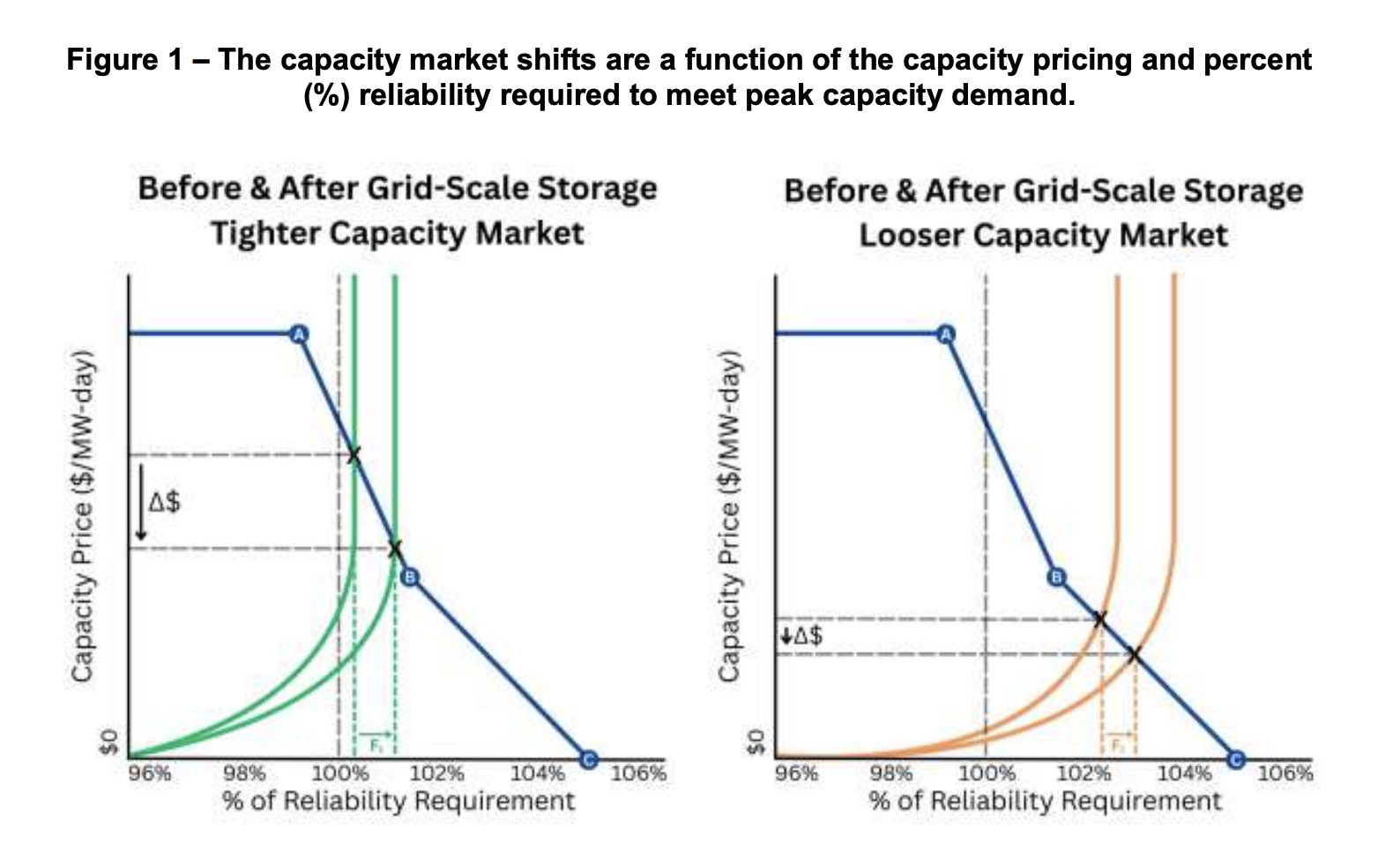

And here’s a fun chart showing its expectation of capacity prices before and after the introduction of grid-scaled storage, both in tighter and looser markets.

__

In Oregon, PacifiCorp filed its Clean Energy Plan to comply with HB 2021, a state law requiring utilities to reduce GHG emissions by 80% by 2030, 90% by 2035, and 100% by 2040.

The preferred portfolio output from its Capacity Expansion Model includes the planned addition of 11,837 MW of new resources over 21 years (2,491 MW wind, 2,152 MW utility-scale solar, 1,032 MW small-scale solar, 3,835 MW storage, 2,045 MW energy efficiency, and 153 MW demand response for Oregon). It also projects $3.374 billion in required transmission investment to satisfy this preferred capacity expansion using annual emissions accounting.

__

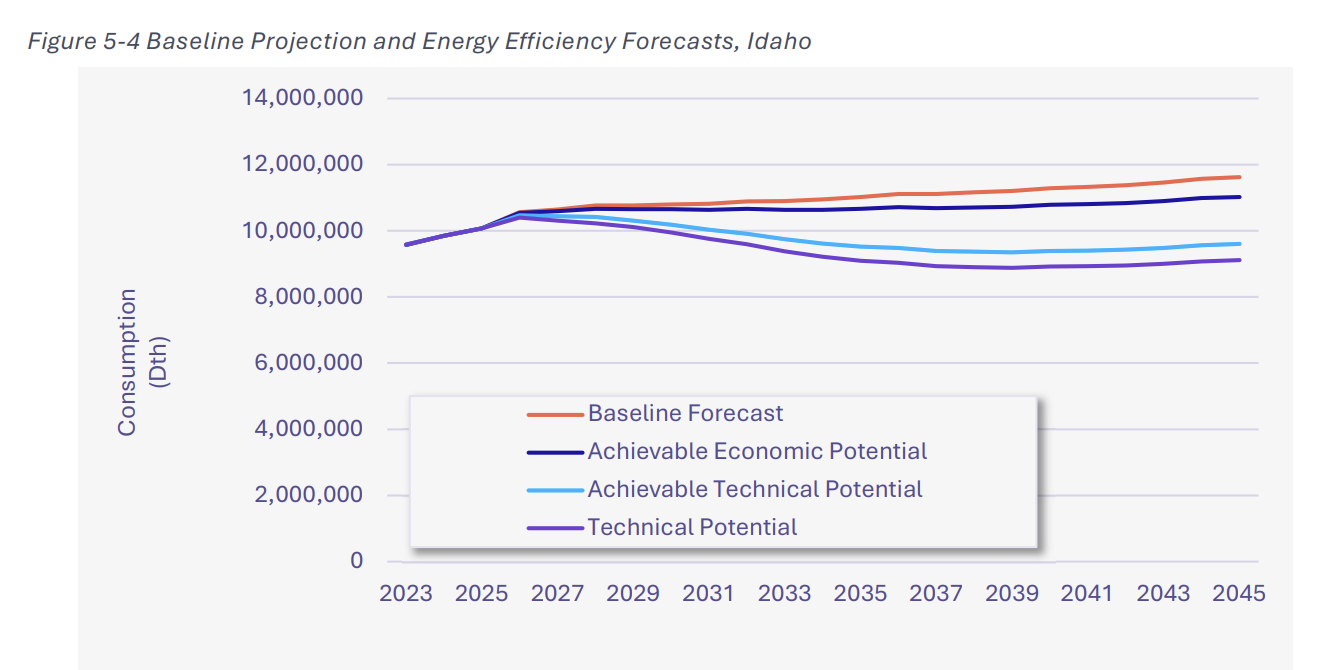

More in the PNW: In Washington and Idaho, Avista Corporation filed its 2026-2045 Natural Gas Conservation Potential Assessment (CPA) for its service territories in both states.

The report concludes that natural gas demand (except for industrial demand) in Washington will decline primarily due to building codes and fuel switching.

__

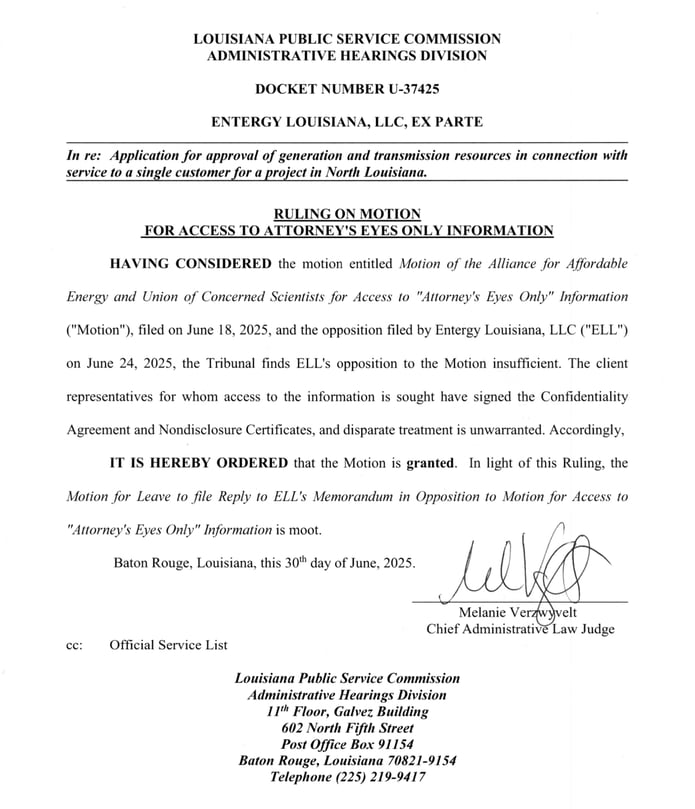

The Louisiana Public Service Commission approved a motion filed by the Alliance for Affordable Energy and the Union of Concerned Scientists, on behalf of their client representatives, to gain access to materials previously categorized as “Attorney’s Eyes Only” by Entergy Louisiana.

The requested materials involve data related to the construction of a hyperscale data center owned by Meta Platforms, as well as communications between Meta and Entergy Louisiana regarding the project.

- Motion Ruling

- Docket profile

- Arguments in favor of Motion (Earthjustice)

- Arguments against Motion (Entergy Louisiana)

__

In Michigan, DTE filed its biannual update on efforts to secure federal funding for infrastructure improvements under the Infrastructure Investment and Jobs Act of 2021 (IIJA) and/or the Inflation Reduction Act of 2022 (IRA). The utility has withdrawn its application for two federal grants – intended for smart grid resiliency programs – citing a “conflict between the grant terms and conditions and DTE’s financial agreements.”

__

RTO time! PJM’s May 2025 Market Report includes two useful charts. First, estimated revenue from Demand Side Response has declined by roughly 80% (~$800 million to $150 million) since 2014. Second, the number of Submitted Bids has roughly doubled since April 2023 (1.5 to 3 million) while the number of Cleared Bids has increased by a smaller margin.

__

More RTO action: MISO and PJM, both stakeholders in the “Interregional Transfer Capability Study” (ITCS), have proposed solutions to address transmission transfer limits between their regions. “After review and preliminary consideration of submissions, combined with MISO developed alternative concepts, 54 solution ideas remain for further evaluation by MISO and PJM.”

__

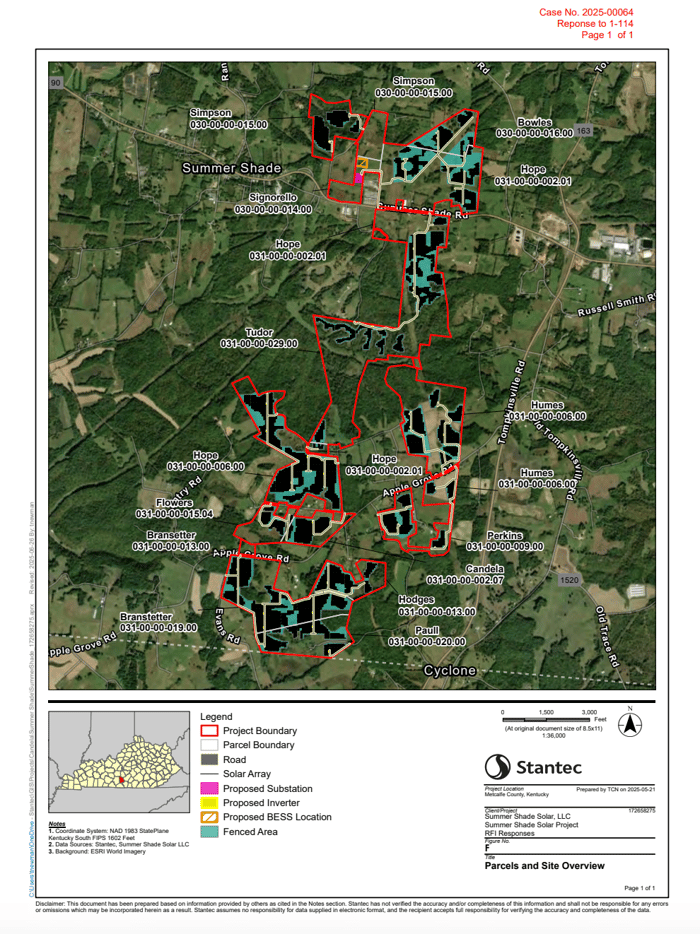

In Kentucky, project developer Candela Renewables filed environmental documents for its proposed 106 MW-AC photovoltaic and 424MWh-storage Summer Shade storage project in southern Kentucky. The developer plans to build the project in a relatively noncontiguous manner due to the site’s unique “topography and constraints.” Noncontiguous, indeed.

__

Bonus round! If you’ve read this far, it’s time for your legal notice clipping of the week – from Virginia. The public has been duly notified of Appalachian Power Company’s new Renewable Portfolio Standard. That notice, however, is competing for eyeballs with The curious case of Cutie Pie.

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)