What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Subscribe below to get these insights delivered straight to your inbox:

What's Happening in Energy — June 27

Powered by Halcyon

__

First: in Iowa, Interstate Power and Light is designing an individual customer rate (ICR) service agreement for a new data center customer. In its words:

“Rider ICR tariff is designed to attract large, incremental electric loads and support economic development by offering flexible, cost-based rates and long-term price certainty for unique, large-volume customers.”

Halcyon is designing a new data product that tracks, measures, and compares large load tariffs — let us know if you are interested.

- Request for review

- Attachments

- Economic impact analysis by the University of Northern Iowa

- Docket profile

__

In Wyoming: High West Energy’s (HWE) 2025 Wildfire Mitigation Plan is now published, with an aim to reduce wildfire risk “through proactive measures.” As they say, “many such examples” in the Far West and Inter-Mountain West — but Halcyon is watching closely as these measures propagate into other U.S. regions as well.

__

Also in Wyoming, Pacificorp subsidiary Rocky Mountain Power seeks approval to join the California Independent System Operator’s (CAISO) Extended Day-Ahead Market (EDAM). Wyoming Industrial Energy Consumers and Office of Consumer Advocate have raised concerns about EDAM’s congestion revenue allocation design.

Regarding benefits, RMP states, “The cumulative WEIM customer benefits are valued at $6,246.27 million through the third quarter of 2024 and PacifiCorp has received approximately $891.5 million of those benefits….If the full suite of EDAM benefits is realized, the entire West could save as much as $1.2 billion annually.”

__

States and rates (1): In New Hampshire, the commission approved Eversource Energy's rates for default energy service (ES) for customers beginning August 1, 2025. This includes:

- An increased share of load is now procured through direct participation in the ISO New England wholesale power markets, especially for the small customer group (from 12.5% to 30%, and now to 50%) and 100% for the large customer group.

- The procurement process splits the year into two periods (August–January and February–July) to reduce price volatility.

- Fixed six-month ES rates are $0.11196/kWh (a 25.4% increase over the current ES rate of $0.08929/kWh).

- Monthly variable rates for large customers:

__

States and rates (2): In Vermont, the Village of Ludlow Electric Light Department (LED) requested a 21.5% rate increase effective July 1, 2025. The increase applies proportionally to all customer classes and aims to cover higher power supply costs, labor costs, and net income needs. From the regulator:

“Due to the magnitude of LED’s proposed Rate Change, the Vermont Department of Public Service... respectfully recommends that the Commission: (1) open an investigation into the justness and reasonableness of LED’s proposed Rate Change; and (2) set a date for an initial conference to set out a litigation schedule for this proceeding”

__

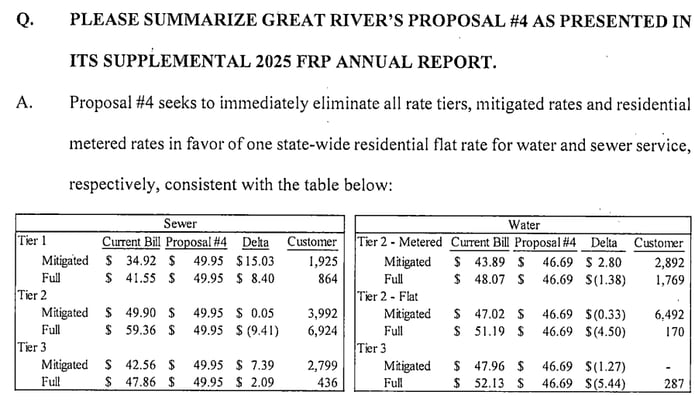

Another state, another (rate) case. The Mississippi Public Service Commission approved Great River Utility Operating Company’s rate increase request – led by a 43% increase in sewer rates.

__

Also in Mississippi, Attala Solar’s $175 million generation facility (200 megawatt AC) received a Certificate of Public Convenience and Necessity (CPCN) and will interconnect via Entergy Mississippi.

A bit of outside-Halcyon searching tells us: Attala Solar is registered to Walden Renewables, in which RWE invested in 2019.

__

In Texas, a study on system vulnerability highlights wind and winter events (if we go all George R. R. Martin about it, the winds of winter). Southwestern Public Service Company (SPS) reports that these events made up 97.3% of all customer minutes interrupted (CMI) from weather-based disruptions, as outlined in its transmission and distribution resilience plan.

__

From the Southwest Power Pool: the estimated annual transmission revenue requirement totals $2.8 billion. One chart jumped out – showing the major discrepancy between predicted and actual revenue requirements.

__

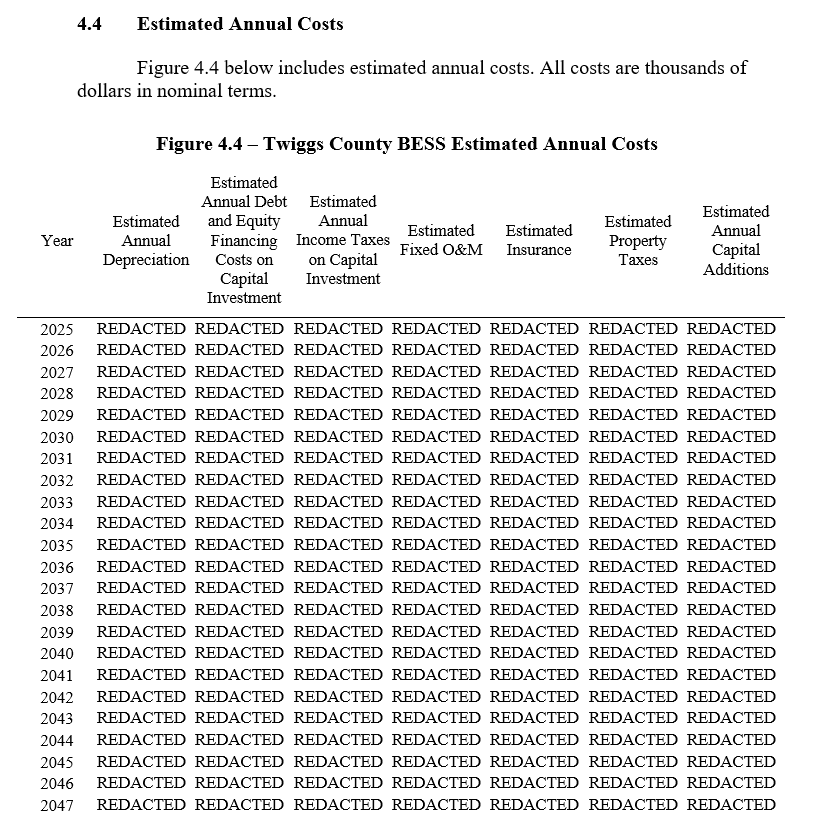

And finally, our favorite visual of the week: Georgia Power Company’s application to certify a Battery Energy Storage System and its estimated annual costs. See if you can spot a pattern in the redaction.

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)