What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Subscribe below to get these insights delivered straight to your inbox:

What's Happening in Energy — May 9

Powered by Halcyon

__

In Georgia, intervenors are concerned that Georgia Power's integrated resource plan may be over-stating data center load. Here are not one, but five great exhibits:

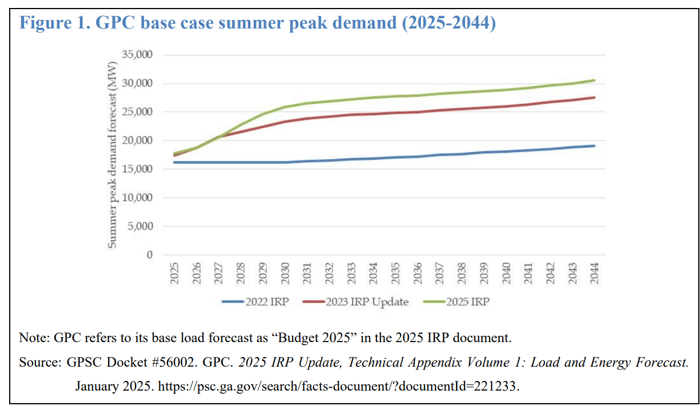

First: 2022, 2023, and 2025 base case summer demand

Second: contracted, service-requested and under-reviewed data center demand in gigawatts

Third: Additions and subtractions to the data center queue in Q4 2024

Fourth: Georgia Power says that it will need 9.4 gigawatts of new capacity by 2033…

…while regulatory staff say the figure is only 6 gigawatts.

__

In Nevada, a brand-new docket: data center operator Switch is building a new 345kV transmission line to serve its project needs.

Docket profile

__

In Colorado, Xcel has received approval for a $2.55 million ‘Thermal Energy Network Pilot Development’ development site.

Filing

__

There are rate increases, and then there are rate increases. The California Water Service Company is seeking an additional $140,558,101 or 17.1% in test year 2026. Water, not power, but still.

Docket profile

Transcript

__

Puget Sound Energy in Washington has kicked off a new power cost adjustment proceeding. See the table below for new supply contracts ‘requesting prudence,’ as well as PSE’s approved risk policy and management framework for hedging practices to help align with wholesale market conditions.

__

Some real inside-baseball stuff in Hawaii: the state commission seems to be moving past performance-based regulation of Hawaii Electric’s target revenues in favor of a full-scale traditional cost-of-service rate case that could result in re-basing its target revenues.

And some…differing perspectives from Hawaiian Electric Company, Ulupono, Blue Planet Foundation, and the Consumer Advocate.

Blue Planet Foundation, for instance, wants to reward the utility for achieved performance along this greenhouse gas emissions path.

__

The state of Wisconsin is reviewing Wisconsin Power & Light’s fuel cost and rates plans. A new group of intervenors has just landed, including Walmart. Why does Walmart care?

Walmart is a large commercial retail customer of Wisconsin Power and Light Company ("WPL" or "Company") owning and operating approximately 18 retail stores, two distribution centers, and related facilities within the Company's service territory. WPL delivers over 83 million kWh of electricity annually to Walmart, mostly under the Company's Industrial Power at Primary or Secondary Voltage – Time of Use ("Cp-1") rate. WPL delivers over 1.5 million therms of natural gas annually to Walmart, mostly under the Company's Medium Commercial & Industrial 20,000 – 200,000 therms ("GC-3F/I") rate. Energy costs comprise a large portion of Walmart's operating costs. As a result, Walmart would be directly impacted by: (1) the adoption of the Company's rate increase request, and (2) any rate design and ratemaking changes approved in implementing any approved increase.

Docket profile

Request to intervene

__

In Texas, Engie's application for its Antlia 70 megawatt battery energy storage project is also deficient, and the company has until May 22 to cure its deficiencies.

Docket profile

Finding

__

Also not a state (rather, an RTO): the Federal Energy Regulatory Commission has determined that Southwest Power Pool’s submitted revisions to its Open access Transmission Tariff to establish separate winter and summer planning reserve margins is deficient, and requires more information. Docket profile

Deficiency Letter

__

Alabama Power is considering the acquisition of the 1,189 megawatt Lindsay Hill combined cycle gas plant for reliability reasons. One of its latest depositions (highly redacted) points to the main driver of new demand: data centers.

Docket profile

Docket profile

Deposition transcript (data center bit starts on page 9 of 113)

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)