What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Subscribe below to get these insights delivered straight to your inbox:

Hey there, it's Nat –

A few programming notes before our weekly rundown:

1. Halcyon has just wrapped up its look at FERC’s resource adequacy technical conference and its 100+ comments from 70+ organizations. We wrote about it in our blog here, and you can find out more at the link below.

2. We are making some upgrades to our Public Utilities Commission of Ohio crawler. Ohio filings may be slightly delayed in the meantime.

What's Happening in Energy — July 11

Powered by Halcyon

__

The Arizona Corporation Commission formally requested information on the presence (and prevalence) of Chinese-made power inverters amongst the states load serving entities and electric cooperatives. Numerous quotes from the LSEs and co-ops, but this one - kill switch-related - from Tucson Electric Power stands out.

The Salt River Project Agricultural Improvement and Power District (SRP) says it’ll double-check its latest inverter intake as well.

The Salt River Project Agricultural Improvement and Power District (SRP) says it’ll double-check its latest inverter intake as well.

__

Microsoft is building a data center in San Jose, California (LBA RVI-Company I, LP, if you’re interested in the entity). This project has filed an Application for a Small Power Plant Exemption with the California Energy Commission to exempt its proposed 97.3 MW of diesel-fired backup generators from requiring the license normally mandated by CEC for thermal generators larger than 50 MW. The CEC permits such exemptions for generating facilities between 50 and 100 MW. The company intends to use the “North-Town Backup Generation Facility” (NTBGF) solely to provide power for its data center campus when power from the expanded PG&E substations is unavailable. In their words, to achieve “99.999%” availability of power. Site plan below; each data center will house 36 MW of critical IT infrastructure.

.png?width=709&height=536&name=unnamed%20(1).png)

__

Also in California, PG&E filed its 2025 Public Safety Power Shutoff (PSPS) Pre-Season Report. The IOU included details on its process for activating “Community Resource Centers” (CRCs) that customers without power could use during a shutoff event.

.png?width=713&height=365&name=unnamed%20(2).png)

PG&E identified the following potential locations for CRCs across its service territory.

__

More (you guessed it) data centers in Kentucky. An ongoing proceeding to approve two combined-cycle gas plants and one large battery installation shows two gigawatts of likely data center load by 2032 (and more than 8 gigawatts of outside-possibility load) in Louisville Gas & Electric’s territory.

Important: Under a scenario with no 40% investment tax credit and a 30% import tariff, the proposed battery project would no longer be economical. Not only that, “Without BESS, the Companies’ ability to support economic development growth is limited.”

__

In New York, Central Hudson Gas & Electric filed its five-year capital investment plan. Overall, net additions in electric infrastructure investment increase from 2026 to 2030 while net expenditures in gas infrastructure decline.

And a good (if somewhat alarming) chart: more than a third of the utility’s power transformers are at least 50 years old, and 0.7% are more than 80 years old!

__

In Maryland, Jade Meadow, LLC, filed updated site plans and decommissioning costs in their application for a CPCN from the Maryland Public Service Commission to build a 300 MW solar facility. The site is a mine reclamation area.

Estimated decommissioning expenses are $15 million…

…But this footnote to the Decommissioning Revenues table is…worth noting.

“Revenue from used panels at $0.10 per watt could raise $39,000,000 as resale versus the estimated salvage revenue.”

__

In Colorado, Amory Lovins has entered the chat, commenting on the Colorado PUC large load docket with some hot takes:

|

“This ability to build many modules extremely quickly makes large-load load forecasting nearly irrelevant. Instead of speculating and arguing about when a large load will arrive and thrive, “Don’t build it and they will come anyway” can add timely, competitive, IPP-or-utility PV+battery modules after the data center is well under construction. Whatever exists is possible.” “Lest the nonzero risks to full reimbursement of utility investments for powering proposed data centers fall instead on other customers, I recommend that such large loads be powered under full take-or-pay contracts to prevent any cost-shifting, and backed by suitable bonding or insurance to guard against throwaway subsidiaries structured to shield Big Tech’s assets from project failure. The default risk would then be priced not by parties to the transaction but by independent capital-market risk-management experts, and the risk would be paid for by the developer who hopes to profit from the project. The cost of such a bond or insurance policy will be small if the risk is truly as small as proponents claim. If the risk isn’t so small, then keeping it with the profits and away from other customers is conservative and prudent. Announcing that policy could deter speculative proposals.” |

And of course, Amory Lovins wouldn’t be Amory Lovins without mentioning “negawatts”, and in the case of data centers, “flexiwatts”?

__

In Oregon, Oregon Public Utility Commission staff have recommended approval of Portland General Electric’s (PGE) $54 million request for wildfire risk mitigation and wildfire-related vegetation measures.

__

In Idaho, there are peak, off-peak, and now Super Off-Peak rates. At least, Super Off-Peak rates are being proposed regarding power service to a new Micron facility in the state.

.png?width=700&height=371&name=ID_Micron_SuperOffPeak%20(1).png)

The testimony included the following justification for this new “Summer Off-Peak” period: “Historically, the Company’s approach to TOU has centered around high risk On Peak hours and includes long periods of Off Peak that include nighttime hours. Those time periods have reasonably aligned with cost dynamics in the past. Those dynamics, however, have changed and merit a change to the time windows for time-varying rates. Price signals should be forward looking. Idaho Power’s market price forecasts demonstrate the emergence of an exceptionally low-price window around 10am to 2pm when solar supply is high relative to demand. See Exhibit 1 for a comparison of historical EIM prices relative to Mid-C forecasts across hours of the day. Note also in Figure 1 (p4) that during all months of the year this 10am to 2pm period shows very low Loss of Load risks, indicating that load increases during this period are unlikely to require capacity resource additions.”

__

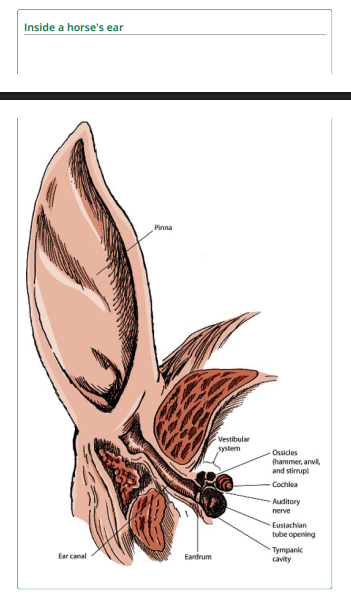

And finally, a Wisconsin solar project approval proceeding features a two-page document explaining the structure and function of a horse’s ear. There’s a picture. It spans two pages for some reason. It’s pretty weird. That is all.

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)