What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Subscribe below to get these insights delivered straight to your inbox:

What's Happening in Energy — June 13

Powered by Halcyon

__

Do you like tracking utility performance using seven Performance and 32 Tracking Metrics? Then ComEd in Illinois has a plan for you, including how to measure its fitness in reliability, resiliency, peak load reduction, supplier diversity, affordability, interconnection readiness, and customer service. Whew. In addition to all of that? ComEd provides return on equity incentives and penalties related to those metrics.

Docket profile

Docket profile

Direct Testimony

Multi-Year Performance and Tracking Metrics Plan

__

To get specific about those metrics, here is ComEd’s system annual load factor* by customer type, ranging from 82.4% for large industrial to 32.1% for residential.

*Annual load factor measures how consistently an electrical system is used throughout the year (i.e. high load factor is associated with a steady load). It's calculated by dividing the total energy consumed (kWh) over a year by the maximum possible energy that could be consumed if the system were running at peak demand (kW) for the entire year (8760 hours).

Docket profile

Docket profile

Tracking metrics progress report for 2024

__

Last week we brought you Pacificorp’s renewables target and its performance towards it (over-performance is more accurate). This week it’s Washington State peer utility Avista. Avista is projected to meet and surpass the 15% renewables target (equivalent of 871,498 MWh) for 2025 of with its 1.6m MWh of eligible renewable resources, exceeding its target even after REC sale revenues ($2m from 2023 through mid-2025).

Docket profile

Docket profile

Compliance report

__

In New Jersey, there are loads of comments on the state’s comments Comprehensive Energy Efficiency and Renewable Energy Resource Analysis (CRA) and 2026 Clean Energy Program Budget (CEP). A few of note:

- American Lung Association,

- ChargeScape on behalf of automotive investors (BMW, Ford, Honda, and Nissan),

- Northeast Chapter of the Combined Heat and Power Alliance,

- U.S. Hydrogen Alliance,

- and the NJ Division of Rate Counsel which states it is, “unable to support this filing”

Docket profile CRA

Docket profile CEP

__

It seems that Rhode Island faces a challenging puzzle to reduce demand on the natural gas distribution system for Aquidneck Island as an alternative to relying on LNG supply. An analysis on behalf of Rhode Island Energy includes, “What amount of technology investment and uptake would it take to mitigate the capacity shortfall?” Check out the various puzzle pieces including demand-side alternatives under various resource portfolio configurations (gas device efficiency, electrification, demand response), estimated cost feasibility, required customer adoption levels, and greenhouse (“GHG”) emissions reduction potential.

Here are demand reductions in the 'no fossil fuel equipment portfolio scenario.

__

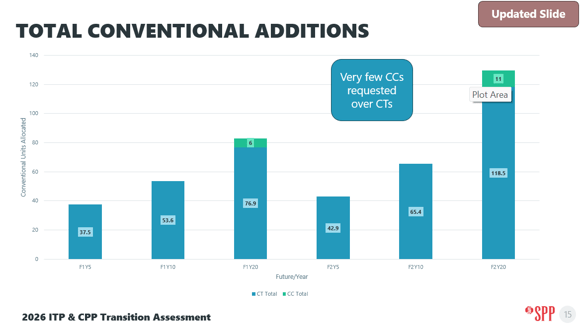

The Southwest Power Pool shares there are very few conventional combined-cycle (energy and capacity resources) as compared to combustion turbines (acting as "peaking units." primarily considered capacity-only resources) additions.

Resource Plan

__

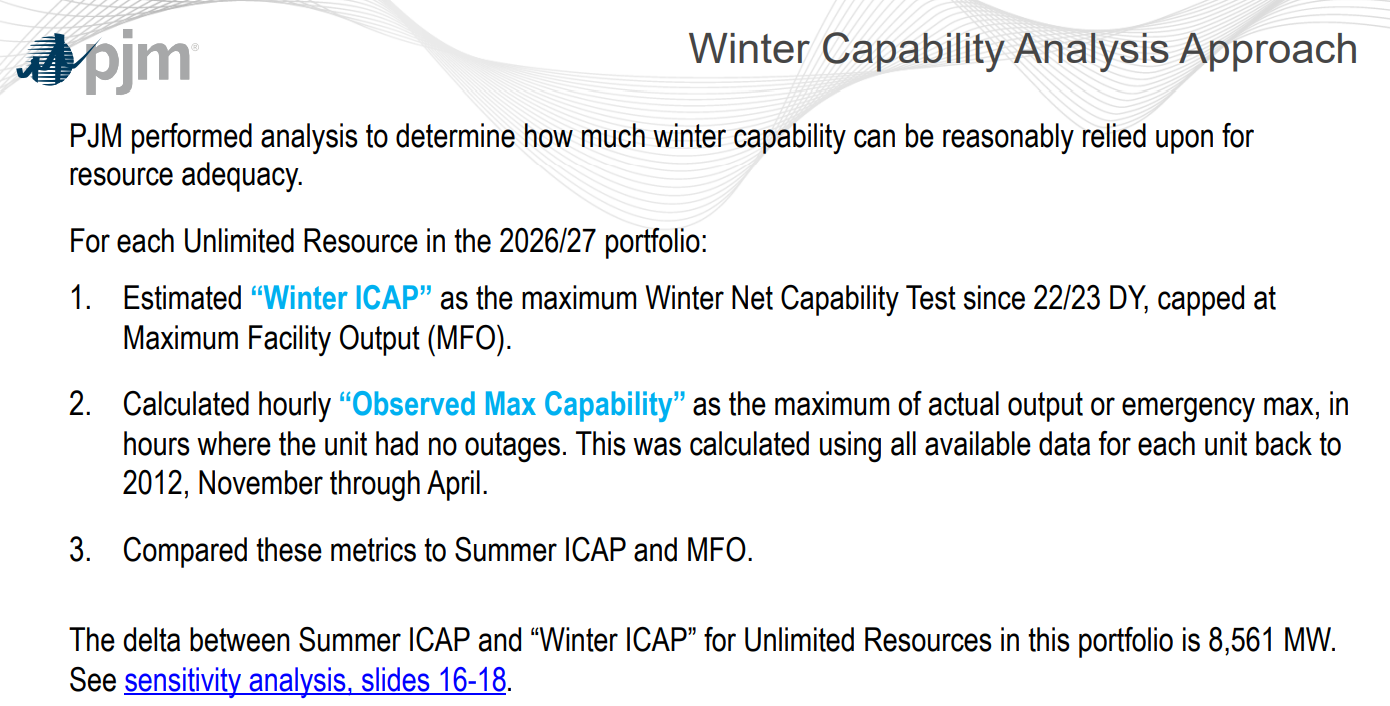

In PJM, there’s an effort to more fully recognize and incorporate seasonal (especially winter) resource capabilities into both the accreditation and deliverability assessment processes. Brought to you by PJM ELCCSTF (that’s the Effective Load Carrying Capability Senior Task Force) evaluating the ICAP or “Installed Capacity” (for the full ICAP definition see PJM manual 21B).

Reflecting Winter Capability in Accreditation Analysis and Initial Proposal - PJM presentation

Reflecting Winter Capability in Accreditation Analysis and Initial Proposal - PJM presentation

__

Also in PJM, a reminder: don’t get phished!

__

And finally things moving fast and slow in Ohio.

Moving slower than expected: a delayed Intel semiconductor facility seeks approval for the continuation of capitalizing Allowance for Funds Used During Construction (AFUDC) allowing AEP Ohio to recover its financing costs as originally planned.

Intel has agreed to reimburse AEP Ohio for any AFUDC capitalized during the delay that causes the project's cost to exceed the original $95.1 million estimate, ensuring no more than $95.1 million will be included in the Distribution Investment Rider (DIR) after the delay. The joint motion states the original intent of the arrangement and holds ratepayers harmless for costs associated with the delay.

Docket profile

__

And moving fast: the Ohio Power Siting Board is authorizing an accelerated review of the 120 megawatt, behind-the-meter natural gas-fired generation project serving the PowerConneX New Albany, LLC data center. PowerConnex has provided the Supplemental Response (the fuzzy preliminary site piping plan - note the reciprocating engines at the top, for more detail see the earlier preliminary site plan). The construction of the project is anticipated to begin as early as the third quarter of 2025, resulting in commercial operations as early as in the first quarter of 2026.

Docket profile

First supplemental response to data request

First response to data request

Original application

Preliminary site plan

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)