What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Subscribe below to get these insights delivered straight to your inbox:

What's Happening in Energy — Oct 31

Powered by Halcyon

____

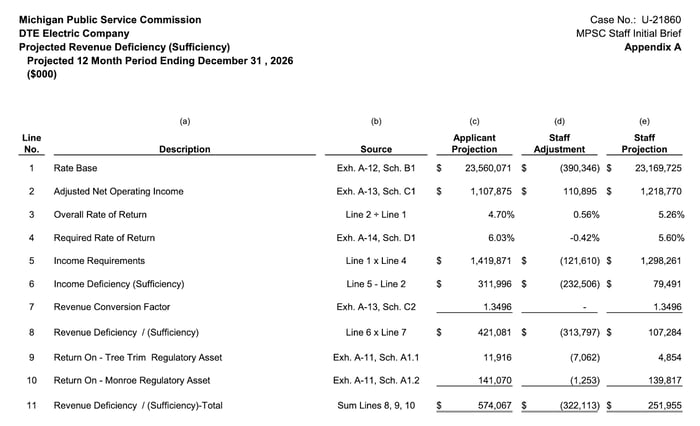

In Michigan, Public Service Commission staff filed an Initial Brief outlining its proposed revenue requirement in DTE’s ongoing rate case. This represents a big change: while DTE requested $574 million; the PSC is proposing a counter of $252 million, which amounts to a $322 million reduction. Below, you can see the difference in revenue requirements:

Some of the largest reductions in revenue result from Staff recommendations to decrease the total utility net plant by $407 million and to increase accumulated depreciation by $23 million. Additionally, Staff recommended reductions in working capital and capital expenditures. In the capital expenditure category, Staff suggested disallowing $31.2 million in capital costs for the Trenton Channel BESS project. This disallowance would further decrease the rate base by $15.7 million and reduce “the expected rate impact of this project by $2.7 million compared to previous cost estimates.” We discussed the update on capital costs associated with the Trenton Channel BESS project previously.

Check out the docket profile and the full Staff Initial Brief below. For more detailed breakdowns of rate cases proceedings and the evolution of revenue requirements, rate bases, and ROEs, grab a spot on the waitlist for our upcoming Rate Case/Cost-of-Capital tracker!

____

In Virginia, Appalachian Power Company (APCo) is requesting “just and reasonable” approval for $122 million of project development costs related to a small modular nuclear reactor. The utility intends to construct the SMR at its Joshua Falls site in Campbell County. According to transcripts, APCo plans to file for cost recovery of project development costs in mid-2026.

The discussion largely revolved around interpretation of subsections from the “SMR statute,” which was enacted by the Virginia General Assembly in 2024. This statute includes a $25 million annual recovery cap and an overall recovery cap of $125 million, not including acquisition costs.

APCo has justified its request to recover costs for a “potential” project that may or may not be activated.

And it's prudent to start now. As Mr. Sherrick discusses, in order to have SMRs as part of APCo's generation portfolio in the mid-2030s, we have to start planning and evaluating and analyzing now. And these activities have associated costs, which is why we are here now before you. And they're well-documented concerns about resource adequacy and reliability in the coming years, given the retirement of thermal units and the inevitability of increasing load, in addition to the mandate and need and desire to bring more clean energy resources online. And the SMRs are part of the plan, APCo's plan, to meet those challenges. But they take time to develop and construct, which is why starting now is prudent and the only course of action for Appalachian.

APCo later responded to the Commission’s inquiry regarding whether large load growth influenced their decision to pursue SMRs. The utility replied that they selected SMRs as a resource based on various load growth conditions. However, they also noted that agreements had already been signed with large load customers:

Yeah, so 120 [MW] is the current signed one. They're looking to double that already before we've even started building. So that gets you up to 240. It's got one that's just over 300. And then I actually have a couple of expansion of existing customers that are non-data center.

Dig into the transcript and the associated docket profile below.

____

Also in Virginia, a reminder that not all large loads are the same. The Department of Defense (DOD) weighed in on the new GS-5 rate class proposal for large load customers. Halcyon’s emphasis is highlighted below in bold:

Dominion proposes to introduce a new rate schedule, GS-5, for large load customers. Dominion’s proposal requires all customers who exceeded 25 MW and have a 75 percent or higher load factor for three months during a year to transfer to this new rate schedule. The new rate schedule contains increased minimum demand provisions as compared to current tariffs.

DOD objects to the mandatory transfer of all customers matching these load conditions to the new GS-5 rate. Many large load military accounts were established decades ago - and there is no evidence that DOD’s load patterns for these accounts have changed.

The Department of Defense objects to any proposal that combines decades-old military installations with newly-constructed data centers into a new customer class that results in military customers suddenly paying dramatically more money for electric service as the sole result of the surge of new data centers to the Commonwealth. The GS-5 rate class proposal unfairly discriminates against legacy military customers. Military installation load patterns have not changed. Therefore, increasing rates charged to military installations beyond the inflation rate is unjustified. The primary motivation for the new GS-5 rate is new large load customers, not any changes in the behavior or load characteristics of existing customers. Existing customers should not be forced to move to GS-5.

Parties have proposed changes to the GS-5 rate class. One proposal is to exempt customers who have been on the system for more than 10 years from the minimum billing demand provisions of proposed Rate GS-5. DOD contends that this is the minimum consideration that should be given to legacy customers, especially major-sector employers, who have been paying to support the system for decades.

Read more comments on Dominion’s GS-5 tariff from Microsoft, Amazon, Sierra Club, and other organizations in the Post-Hearing Briefs filed in the docket profile linked below.____

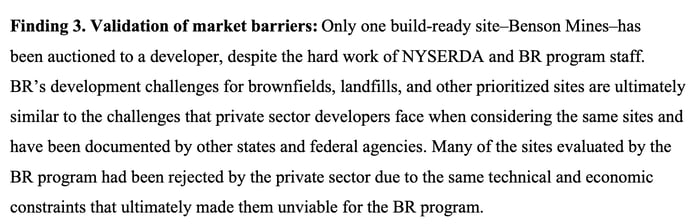

In New York, a report prepared by Industrial Economics for the New York State Energy Research Development Agency (NYSERDA) evaluated the progress of NYSERDA’s Build-Ready (BR) program, which was established five-years ago. The program was designed to facilitate renewable energy development on brownfields, landfills, and other “BR-prioritized sites.” So far, the BR program has successfully auctioned off a single site, Benson Mines, for a 12 megawatt (MW) solar facility. The report indicated that while the agency has developed critical institutional expertise in program implementation, the biggest obstacle to scaling it remains market barriers:

The report lists several common challenges associated with renewable development on brownfields and landfills: higher costs, site characteristics such as sloped land, and the need for extensive environmental assessments and permitting. Furthermore, legislative constraints have narrowed the initial estimate of 16,400 acres of viable sites down to a “small portion.”

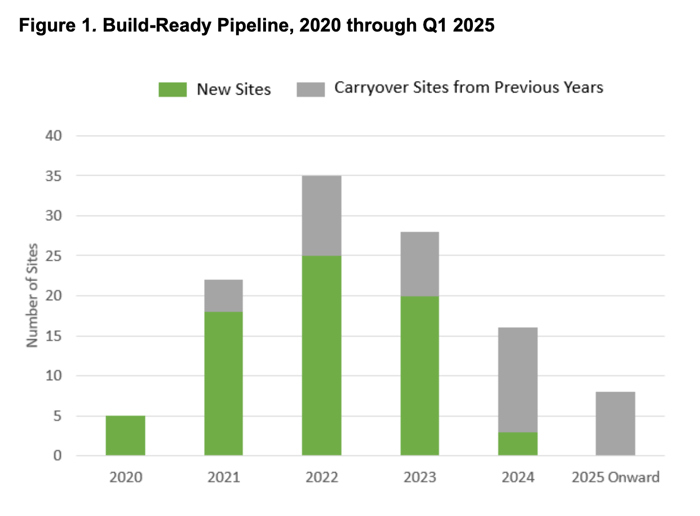

“Moreover, for the sites that passed initial screening and progressed to the program pipeline, the rate of site attrition was high due to other issues, including challenges in coming to terms with site owners, difficulties in obtaining site easements, and significant interconnection costs. Figure 1 depicts the number of sites that passed the initial site screening and proceeded to a more detailed site assessment.”

See Figure 1 referenced in the above passage below. From 2020 to 2022, viable sites in the pipeline increased from 5 to 35, followed by a decline down to below 10 in 2025.

____

In ERCOT, a 2025 Regional Transmission Planning Economic Analysis Update indicates varying net peak load outcomes for 2027 and 2030, based on two scenarios that assume different levels of large load and generator interconnections.

-3.png?width=700&height=305&name=unnamed%20(1)-3.png)

In the base case, all contracted large loads and a fraction of “Officer Letter loads” were included. In contrast, the sensitivity case included all contracted large loads but excluded all “Officer Letter loads.” On the generating side, the base case accounted for generators that had started but not yet completed the Full Interconnection Study (FIS), whereas the sensitivity case did not include any generators with partial FISs.

The results show a significant difference in the amount of “Natural Gas Added” between the two cases. By 2030, the sensitivity case has 17 GW less natural gas generation capacity added compared to the base case! This accounts for approximately 50% of the total difference in generation capacity, (~34 GW), between the two scenarios in 2030.

-Oct-30-2025-05-36-14-2271-PM.png?width=700&height=289&name=unnamed%20(2)-Oct-30-2025-05-36-14-2271-PM.png)

____

Also in Texas, Stella Energy Solutions has submitted 10 filings to the PUCT, notifying the Commission that each 9.9 MW project qualifies to self-certify as an “exempt wholesale generator." Each notice contained the following colorful clause:

“IV. STATE COMMISSION NOTIFICATION

As required by section 366.7(a) of the Commission's regulations, a copy of this self certification has been filed with the State of Mind Public Service Commission, the state commission of the state in which the Facility is located.”

Check out the filings before the State of Mind PSC below.

____

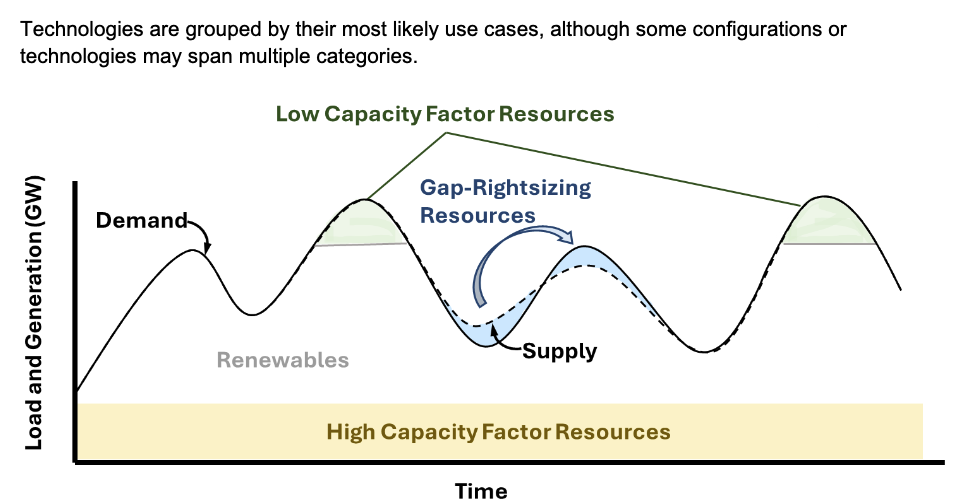

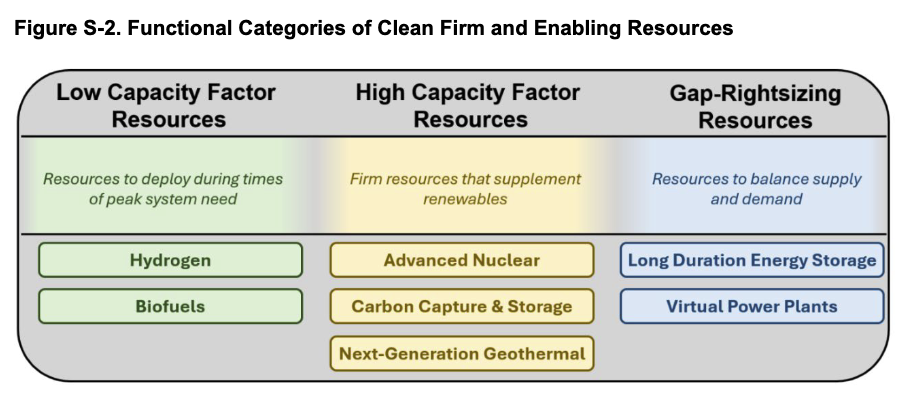

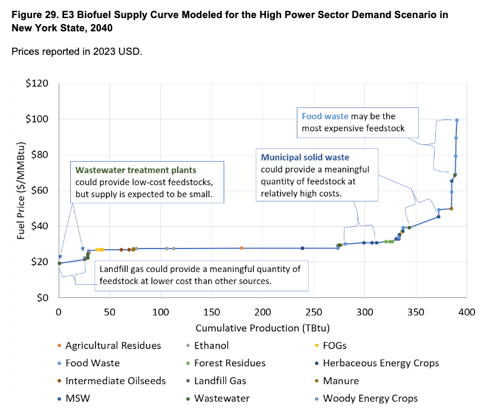

Back to New York, the New York State Energy Research Development Agency (NYSERDA) has submitted a technical feasibility analysis in support of the Commission’s Order Initiating Process Regarding Zero Emissions Target. This initiative seeks “to identify technologies that can close the gap between the capabilities of existing renewable energy technologies and future system reliability needs, and more broadly identify the actions needed to pursue attainment of [New York State’s] Zero Emission by 2040 target.”

NYSERDA’s 458 page “Zero by 40 Technoeconomic Assessment“ specifically focuses on dispatchable emissions free resources (DEFRs).

No-Regret Actions include:

- Pursue a diverse set of resources to minimize the risk of overreliance on individual technologies.

- Start early to increase the likelihood of readiness by 2040.

- Invest in grid-enhancing technologies early to minimize the need for backstop resources.

- Invest in innovation to enhance resource viability.

- Develop strategies across industries for unlocking key resources with infrastructure hurdles.

- Engage early with technology developers, end users, and other stakeholders.

- Conduct grid modeling to understand tradeoffs of relying on different resources.

- Conduct a regular reassessment of options and remain flexible as new technology options come online.

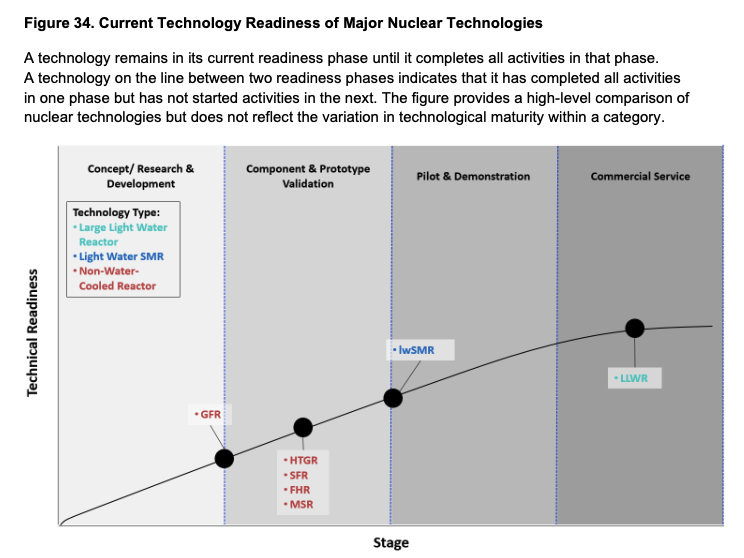

And a great overview of nuclear fission:

__

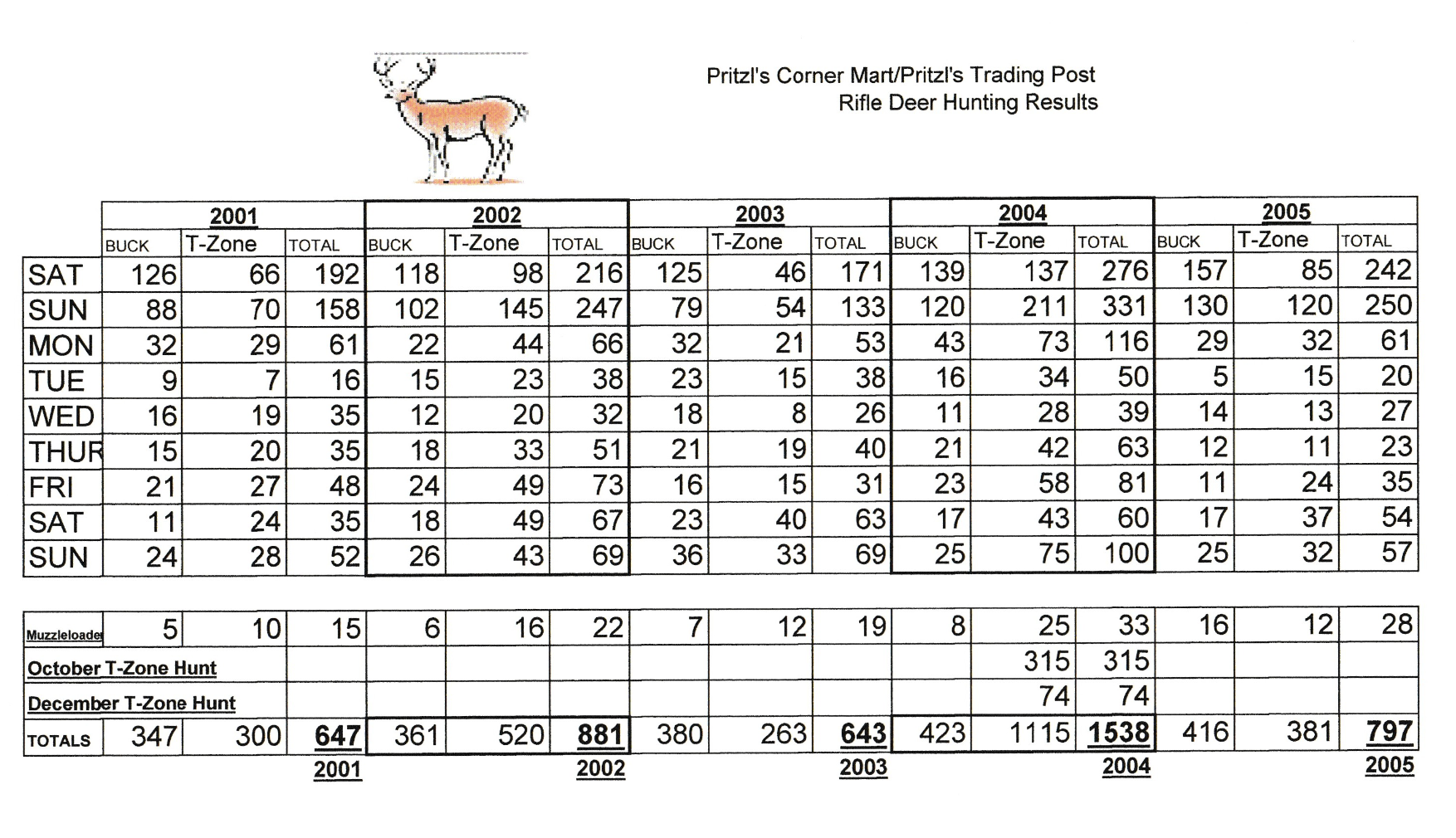

In Wisconsin, there are updates regarding the Akron Solar, LLC application for a Certificate of Public Convenience and Necessity (CPCN) for a 200 MW Solar Electric Generation Facility. This application also includes plans for a Collector Substation, a Generation Tie Line, and a Battery Energy Storage System. There have been a variety of interesting filings from the fire chief to the Town Chair of the Town of Rome (with exhibits from an ATV UTV, snowmobile trail map, all hazards mitigation plan, and rifle deer hunting harvest as shared below).

__

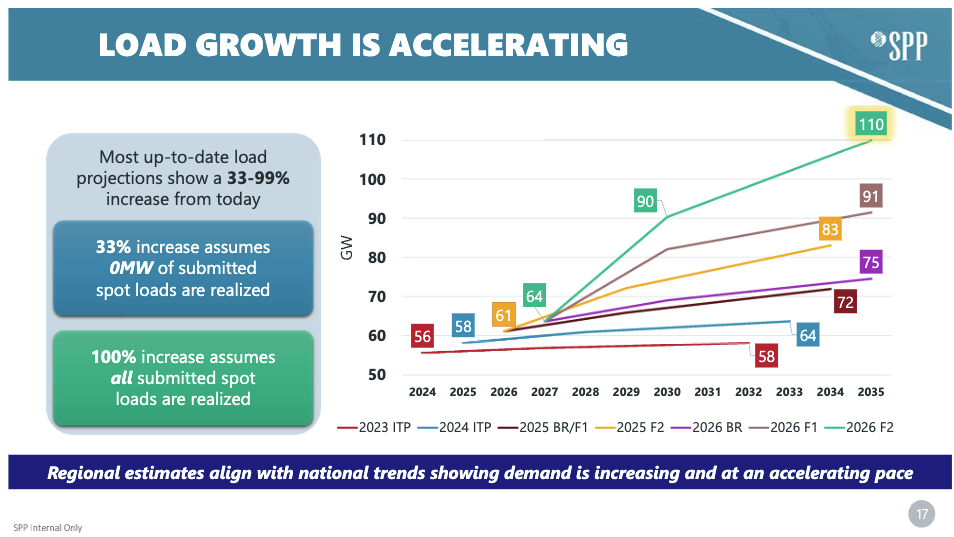

The Southwest Power Pool (SPP) has released a 1,042-page draft agenda for the Board and Members Committee meeting, along with supplemental materials, in advance of next week’s meeting. Recently, we have been covering SPP’s Integrated Transmission Plan (ITP), and two visuals from the materials caught our attention. First, no surprise, load growth.

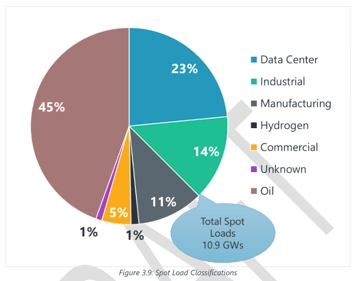

The second is spot loads beyond just data centers: including oil and gas electrification (the majority in figure below), manufacturing, and industrial production as well. SPP notes that, “load growth of this magnitude introduces serious challenges — thermal overloads, voltage collapse, and economic inefficiencies — exacerbated by extreme weather and generation shortfalls.”

__

And a final thought: this Arkansas rate case for Southwestern Electric Power Co (SWEPCO) features a swath of that rarely-seen document classification, the Sur-Surrebuttal.

For the visual learners:

-3.png?width=429&height=601&name=unnamed%20(3)-3.png) Note: meme by Halcyon, not by SWEPCO or the Arkansas Public Service Commission

Note: meme by Halcyon, not by SWEPCO or the Arkansas Public Service Commission

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)