What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Hey there, it's Nat –

New Data Subscriptions! Join the waitlist!

This week coming off Thanksgiving turkey tryptophan, Halcyon launched a brand new Battery (BESS) data subscription, shared FERC ANOPR comment analysis (inquire about both here), and the normally scheduled What’s Happening in Energy below.

Remember you can view the documents linked herein, but you must authenticate with a code sent to your email address (and sometimes in spam).

Subscribe below to get these insights delivered straight to your inbox:

What's Happening in Energy — Dec 5

Powered by Halcyon

____

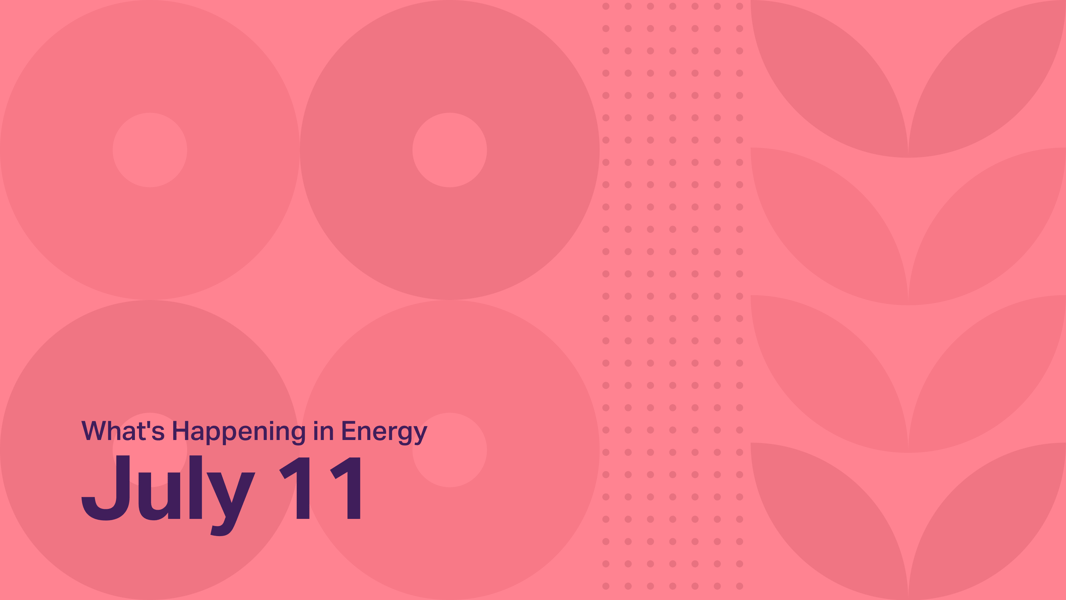

In Washington, Cascade Natural Gas has submitted cost and incentive estimates for its proposed Thermal Energy Network (TEN) pilot. The pilot aims to demonstrate the viability of TENs, which supply heating, cooling, and domestic hot water sourced from a network of pipes filled with water that use the subsurface as a source and sink.

See cost estimates for the proposed pilot in Bellingham, WA, in collaboration with Bellingham Technical College:

Cascade estimates that $9.9 million could come from Investment Tax Credits, government grants, and utility rebates, leaving ratepayers on the hook for the remaining $12.1 million.

“Cascade also addressed the potential for its current single customer for the pilot to serve as an anchor for future expansion…. The single customer pilot largely happened due to the tight timeline of finding a pilot…. Another aspect to consider is that a potential powerful template for TENs comes from the existing district energy industry where a district energy system/TEN is anchored by a large commercial load and then expands out to reach additional customers.”

To view TENs across the U.S. with size and cost details, check out this Halcyon Query.

____

It is shocking to see that outdated information systems are holding utilities back from providing timely status reports.

In New Jersey, Public Service Electric and Gas Company (PSE&G) and Jersey Central Power & Light Company (JCP&L) have filed interconnection queue status reports in the Board of Public Utilities (BPU) interconnection modernization docket. Both utilities stated they are unable to provide much of the information requested by BPU due to the outdated systems.

According to JCP&L:

“The Company has different processes to manage the interconnection requests… developed long before .. this new report and aren’t currently interconnected in a manner to facilitate this report in its entirety without significant manual research.”

According to PSE&G:

“systems and databases to manage the interconnection requests … were developed long before the requirements of this new report and aren’t currently interconnected in a manner to facilitate this report in its entirety without burdensome manual research.”

PSE&G provided a specific example: one of the data points requested by the BPU has simply never been collected. The utility wrote that manually, “it would be unduly burdensome for PSE&G to conduct a manual review of the 20,000+ applications currently in its queue to satisfy this obligation.” PSE&G states, “it will be making necessary information technology upgrades to comply with Order 8C and the Grid Modernization Rules once finalized.”

- Docket profile

- JCP&L filing

- PSE&G filing

- To view utilities with planned IT upgrades in 2026 and beyond, check out this Halcyon Query

____

In PJM, the Critical Issue Fast Path - Large Load Additions is a process to integrate large load customers rapidly and reliably, without risking an electricity supply shortage, had the Joint Stakeholder Package rejected at the PJM Members Committee. This Joint Stakeholder Package from Amazon, Calpine, Constellation, Google, Microsoft, and Talen was overwhelmingly voted against by transmission owners, end-use customers, and electric distributors. In contrast, most of the votes in favor came from generation owners (i.e. overall buyers were against and sellers were in favor).

-4.png?width=700&height=558&name=unnamed%20(4)-4.png)

Check out the results of the vote broken down into many different permutations of the entities.

Also in PJM, the RTO briefed the Load Analysis Subcommittee on Large Load Adjustments in preparation for the 2026 Load Forecast. This briefing compared requests for large load forecasts categorized as non-firm and firm. Only load categorized as firm will be included in the RPM (Reliability Pricing Model - i.e. PJM capacity market).

-2.png?width=1600&height=885&name=unnamed%20(6)-2.png)

PJM will continue to refine these adjustments until the finalization of the 2026 Load Forecast in January. See the presentation for utility-level breakdowns and key assumptions.

____

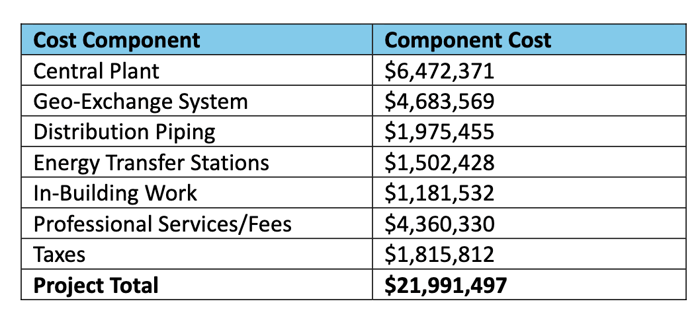

In California, CodeCycle, a nonprofit that develops software to streamline energy code compliance, has filed a complaint before the California Energy Commission (CEC) regarding the growing burden that Title 24 (CA’s Building Energy Efficiency Standards or CA energy code) places on local building departments. The group argues that the volume and complexity of the new code requirement is having a negative effect on the ground.

The Standards, as adopted, are likely prudent in an idealized world where CEC mandates somehow just happen. But that is not this world. We cannot go into the intricacies here, but a substantial portion of the intended savings from Title 24-2025’s new code measures could be offset by increased noncompliance across the whole of the Standards. For every 10 kWh of additional savings the State and IOUs claim from new code measures, increased compliance and enforcement challenges with the whole range of the Standards could be costing Californians 8 kWh. The Standards are in many ways cannibalizing themselves as they compete for overwhelmed compliance and enforcement resources.

Below a table and chart of the increasing length of Title 24.

____

In Arizona, a 3,200 megawatt (MW) aggregated interconnection co-tenancy [want to understand what co-tenancy means?– More here] has filed for a second amended and restated Large Generator Interconnection Agreement (LGIA) Co-Tenancy Agreement. The co-tenants each own, operate, or are in the process of developing a solar (PV) or battery energy storage system (BESS) in La Paz County.

This update adds four new entrants (Atlas12-15) and revises co‑tenant percentage interests (see Exhibit A).

-1.png?width=672&height=768&name=unnamed%20(7)-1.png)

____

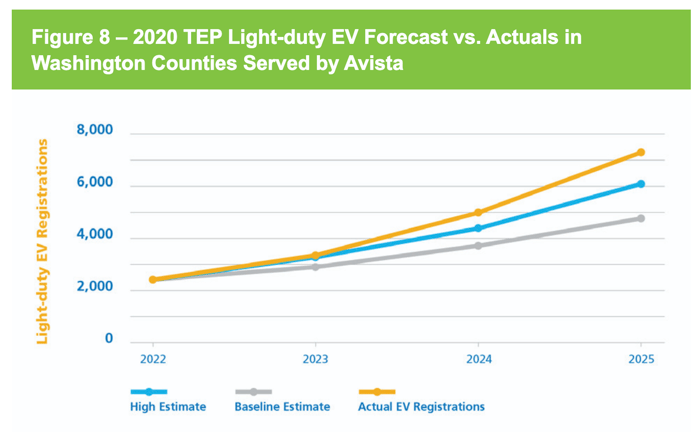

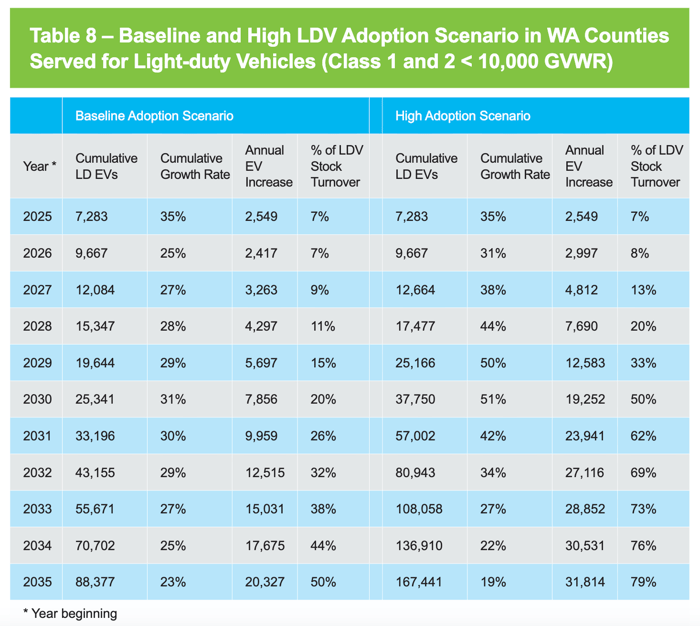

In Washington, Avista submitted its 2025 Transportation Electrification Plan (TEP), reporting strong light-duty electric vehicles (LDEV) adoption.The LDEV update surpassed the 2020 plan’s high-adoption scenario by 19%.

For the 2025 plan, Avista anticipates promising but uncertain LDEV growth through 2035:

Adjustments include a reduction from recent 50% annual cumulative growth to 35% in 2025 and 25% in 2026, gradually increasing to 20% of stock turnover (a proxy for new sales penetration) by 2030 and then more rapidly increasing to 50% of stock turnover by 2035.

Avista explains that these projections reflect “stock turnover,” which refers to the annual replacement rate of existing vehicles. The company also notes that weaker national policy support, along with uncertainty regarding battery costs and technology advancements set a ceiling on future stock turnover at 50% by 2035 in the baseline scenario.

____

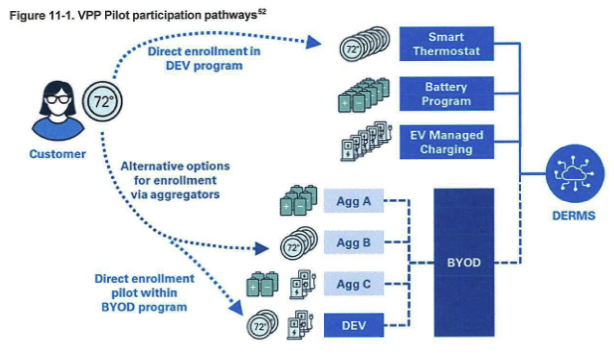

In Virginia, Dominion Energy released its 2025 Demand Side Management update this week, including 11 new programs seeking approval. Five of these new programs, and three existing ones, will be integrated into the Virtual Power Plant (VPP) Pilot. Existing offerings—smart thermostats, managed EV charging, and energy efficiency programs—will form the foundation for flexible, customer-driven grid support.

The pilot will expand options to include residential battery storage and other emerging DERs. If approved, customers will be able to enroll in the VPP either directly through Dominion’s demand response (DR) programs or through a participating aggregator Aggregators may provide various devices, event options, or incentives to customers. Additionally, Dominion will act as an aggregator for the bring-your-own-device (BYOD) program, allowing up to 1,000 customers to enroll directly with the utility.

Figure 11-1 shows how the aggregator-based BYOD program will operate alongside Dominion’s existing programs.

The BYOD Aggregator Access pilot has a projected total cumulative participation of 16.3 MW and the Industrial Pilot version has total cumulative participation of 65.3 MW from 2027-2030.

- Docket profile

- To see all 16 documents Dominion filed this week use this Halcyon search.

____

The next three are like an impressive Texan three-ring circus—if the circus were run by PhD researchers, market monitors with calculators in their holsters, and a tech giant getting batteries like circus souvenirs.

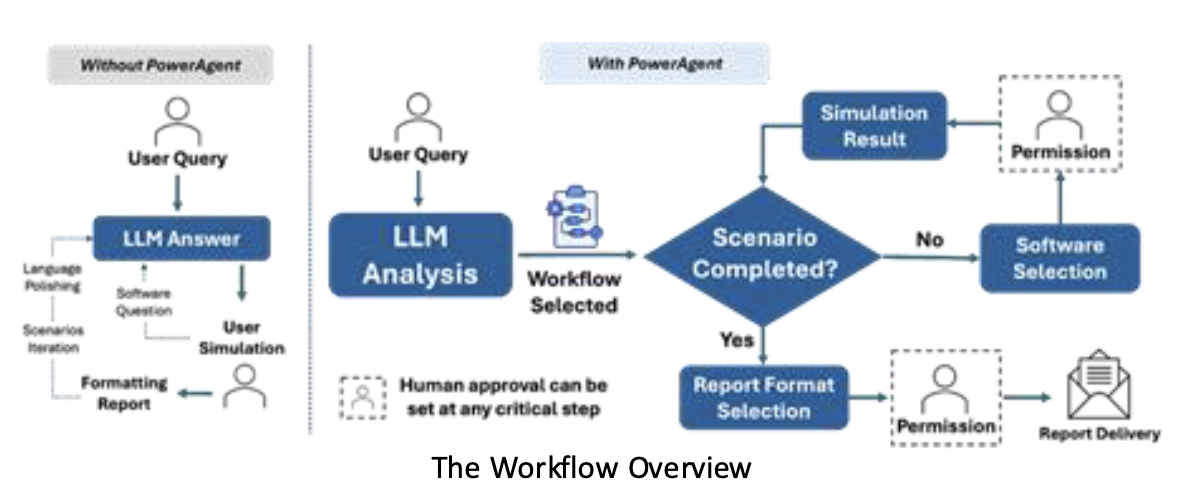

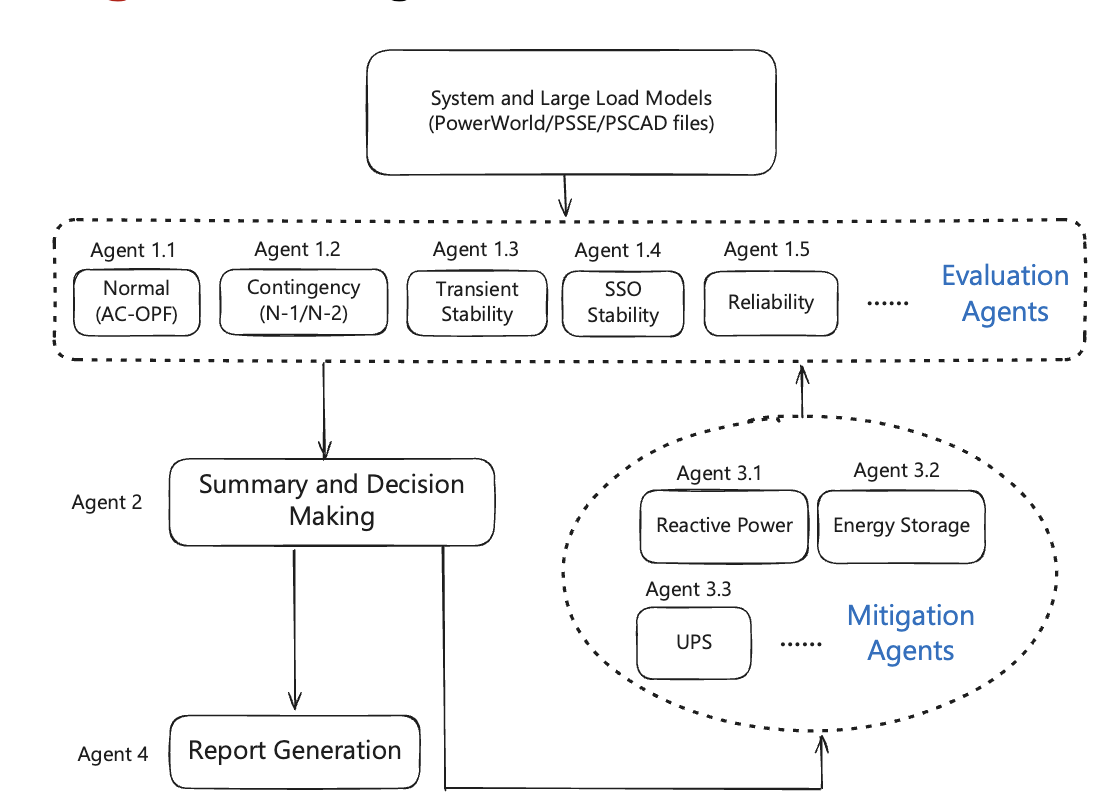

First up in ERCOT, Harvard Professor Le Xie filed a presentation slated for the December 8th meeting of the Technology and Security Meeting, focusing on the potential of Agentic AI in the power system. This presentation addresses the interplay of foundation models in the power sector (operation, planning, scheduling, and siting) and enhancing the interaction of AI with those power systems. Xie defines the design of Agentic AI as “Enabling LLMs to interact with the environment.” Compared to previous bottlenecks in AI adoption across the industry, LLMs “require only light fine-tuning or RAG to adapt to power systems – no massive datasets or full retraining needed.” These agents can use “trusted” power modeling tools and facilitate human-in-the-Loop control at any point within the decision-making process.

The presentation also included a visualization of the various domain-specific agents that would be involved in the workflow.

Check out the full presentation linked below.

__

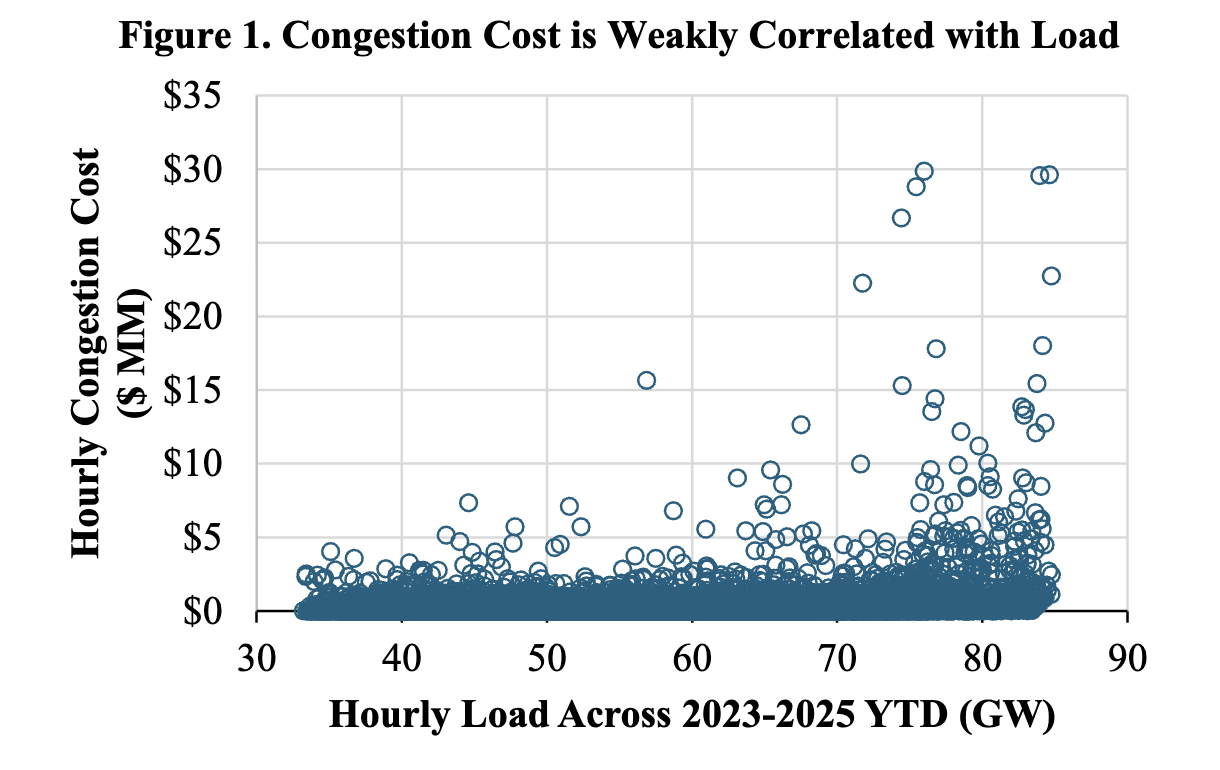

Also in Texas, the Independent Market Monitor (IMM) submitted comments recommending an alternative to the current “4CP” transmission cost allocation. Currently, this methodology allocates transmission costs based on the share of total load that a load-serving entity has during the four 15-minute intervals with the highest peak demand across the system from May through July. Since 2015, the IMM has consistently urged the PUCT to abandon this methodology in every State of the Market report. It encouraged loads to shift their demand during these intervals and avoid cost responsibility:

Certain types of loads, including data centers and cryptocurrency mines, have greater capability than ever to alter operations strategically. These customers can avoid a substantial share of system costs even when they are major contributors to local transmission needs.

The IMM recommended a new methodology that would allocate costs based on loads’ shares of coincident peaks during hours of highest congestion. The IMM argued that congestion is a more significant cost driver than peak demand, which is only loosely correlated with the hours of highest congestion.

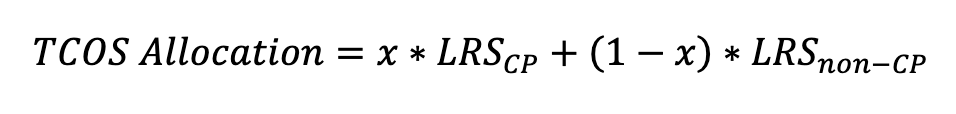

The new methodology proposed by the IMM aims to allocate the cost responsibility of a load-serving entity. This is done by adding together two components: the average load ratio share multiplied by the percentage of total congestion costs from a certain number of hours with the highest congestion costs in a year, and the average load ratio shares across the remainder of the year multiplied by the remaining percentage. See the equation and the percentages based on the selected number of hours below.

Dig into the IMM’s arguments and more of their recommendations in the link below. Also, check out the full docket proceeding to view other comments on the PUCT’s evaluation of the transmission cost recovery methodology in Texas.

__

Also in Texas, IP Quantum II BESS, LLC has filed an application to register as a Power Generation Company for a 320 MW / 640 MWh energy storage facility in Haskell, TX. This facility will be interconnected with Oncor transmission within ERCOT. All of the facility’s output is intended for Google Energy, with anticipated commercial operation in June 2026. Commission staff recommend approval, and Intersect requests an expedited ruling.

For a quick peek at the Battery energy storage systems (BESS) tracker or if you are interested in the workbook that summarizes the 175 comments submitted regarding FERC’s ANOPR RM26-4-000 let us know.

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)