What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Subscribe below to get these insights delivered straight to your inbox:

Editor's note: Halcyon launched its latest data product, a Large Load Tariff Tracker, this week! Read more about it here, or reach out below for a preview of the data and pricing information.

What's Happening in Energy — July 25

Powered by Halcyon

__

Everything’s bigger in Texas. ERCOT presented a breakdown of pending large load interconnections through 2030 in its June 2025 Monthly Operational Overview. The majority of MWs throughout the rest of the decade fall under the “No Studies Submitted” category, meaning they lack sufficient information for further ERCOT review or were rejected in initial planning studies until sufficient interconnection capacity is identified.

__

Things are big elsewhere, too! Hello, giant battery in California. The California Energy Commission (CEC) has received an application to construct the 1,150 MW (9,200 MWh) Prairie Song Reliability project in the Antelope Valley of northern Los Angeles County. Standard stuff in one way (four eight hours’ storage) but…it’s very big, and it comes with a new 500kV transmission line to connect to Southern California Edison’s Vincent substation.

.png?width=700&height=454&name=CA_CEC_Prairie_OptIn_App_Site_Layout%20(1).png)

- Docket profile

- CEC letter with site plan

- Prairie Song Reliability Project Application Part 1

- Prairie Song Reliability Project Application Part 2

__

Another big number: In Missouri, Liberty Utilities is requesting a minimum 29.15% rate increase for residential consumers. Check out the table below, and the docket in the links.

__

In Minnesota, Northern States Power Company (Xcel Energy) submitted a petition to the Minnesota Public Utilities Commission proposing two new large load tariffs. First: the Large General Time of Day tariff. Second: the Large Peak Controlled Time of Day tariff. The company detailed its plans to implement these new tariffs through 15-year Electric Service Agreements (ESA) that would stipulate provisions to allocate incremental system costs to new large loads with greater than 100 MW of demand. Provisions include capacity reduction fees, incremental cost tests, and financial commitments of at least 75% of contracted demand. Customers enrolling in the Large Peak Controlled Time of Day tariff must have at least 3,000 kW of controllable demand.

Proposed rates for each tariff below.

Large General Time of Day tariff rates:

.png?width=700&height=227&name=MN_Xcel_LGTDS_Rate%20(1).png)

Large Peak Controlled Time of Day tariff rates:

.png?width=1302&height=664&name=MN_Xcel_LPCTDS_Rate_2%20(1).png) Dig into the docket profile and the filing below:

Dig into the docket profile and the filing below:____

In New Jersey, the New Jersey Board of Public Utilities approved a waiver requested by the North Jersey District Water Supply Commission (NJDWSC) and Nexamp Solar to construct 10 MW DC of floating solar on the Wanaque Reservoir in the Highlands Preservation Area. The waiver is required to participate in New Jersey’s Competitive Solar Incentive Program (CSI) because the program restricts development on certain protected lands. The project had initially been denied a waiver in January 2024. Still, since then, the petitioners successfully consulted with the New Jersey Department of Environmental Protection (NJDEP) and the Highlands Council (Council) to remedy previous deficiencies through a “permit readiness checklist”.

Exhibits filed in the docket proceeding include a sketch of the proposed facilities in the Wanaque Reservoir:

.png?width=700&height=612&name=NJ_Nexamp_NJDWSC_Floating_Solar_Map%20(1).png)

As longtime solar analyst Jenny Chase has described, floating solar for almost a decade, it’s solar on a boat.

__

In SPP, the Western Reliability Executive Committee received a presentation from the Western Electricity Coordinating Council on wildfire trends across the western interconnection. The presentation included a detailed breakdown of outages by line voltage and reasons for outages since 2017.

____

In Montana, NorthWestern Energy has requested that the Montana Public Utilities Commission approve the settlements reached between the utility and stakeholders, including the Large Consumer Group (LGC), Montana Consumer Counsel (MCC), and theNorthern Cheyenne Tribe, regarding its rate increase initially filed in July 2024. NorthWestern provided waterfall diagrams illustrating the various iterations of the base revenue increase proposals brought forth by NorthWestern, LCG, and MCC. NorthWestern requests that the Commission approve its settlement proposal for the electric base revenues ($110.3 million) and the joint settlement proposal for the gas base revenues ($18 million). The most significant concession from NorthWestern was its agreement to reduce Return on Equity (ROE) from 10.8% to 9.6-9.65%.

Also of interest: NorthWestern also requested to recover $38.4 million through its Power Cost and Credits Adjustment Mechanism (PCCAM) to manage rising costs associated with market purchases during extreme weather events. It provided a chart showing the expense increases related to market purchases of more than $500/MWh during such events since 2020.

__

In Wisconsin, Alliant Energy’s subsidiary, Wisconsin Power and Light (WPL), requested “Relevant Electric Retail Regulatory Authority” (RERRA) verification from the Public Service Commission of Wisconsin to support its application to MISO for expedited interconnection under the Expedited Resource Addition Study (ERAS) process. The three projects WPL is requesting to interconnect include a 150 MW wind farm that would enter operation by December 31, 2028, and upgrades to two combustion turbine plants, resulting in a combined increase of 300 MW, which is expected to enter operation by the end of this year.

WPL leans pretty hard on urgency in its formal request:

“WPL hereby requests the PSCW provide a written verification by August 4, 2025 to accompany the interconnection requests for the Projects to allow the interconnection applications to enter the ERAS process within the August 6-11, 2025 submission window. Provided as Attachment 4 is a sample verification letter which could be used by the PSCW in responding to this request.”

__

In Arizona, the Arizona Corporation Commission (ACC) is reviewing a request to transfer the assets of Thim Water to Thim Utility. However, the Commission noted discrepancies in the Applicants’ submitted data and information compiled from databases operated by the Arizona Department of Environmental Quality (ADEQ) and the Arizona Department of Water Resources (ADWR).

“Staff used information on databases operated by the Arizona Department of Environmental Quality ("ADEQ") and the Arizona Department of Water Resources ("ADWR") to create the system descriptions in this report. The information provided by the Applicants has significant differences from the information compiled by ADEQ and ADWR, and Staff has very little confidence in the information provided by Thim Utility and Thim Water.”

This chart is striking. Commission staff filed a report charting water losses, demand, production, and storage levels for the systems owned by both utilities. According to the report, in one of the systems owned by Thim Utility, Rancho Vista lost 84.3% of pumped water (roughly 12.6 out of 15 million gallons) in 2024.

.png?width=700&height=536&name=AZ_TW_RanchoVista_Water_Losses%20(1).png)

__

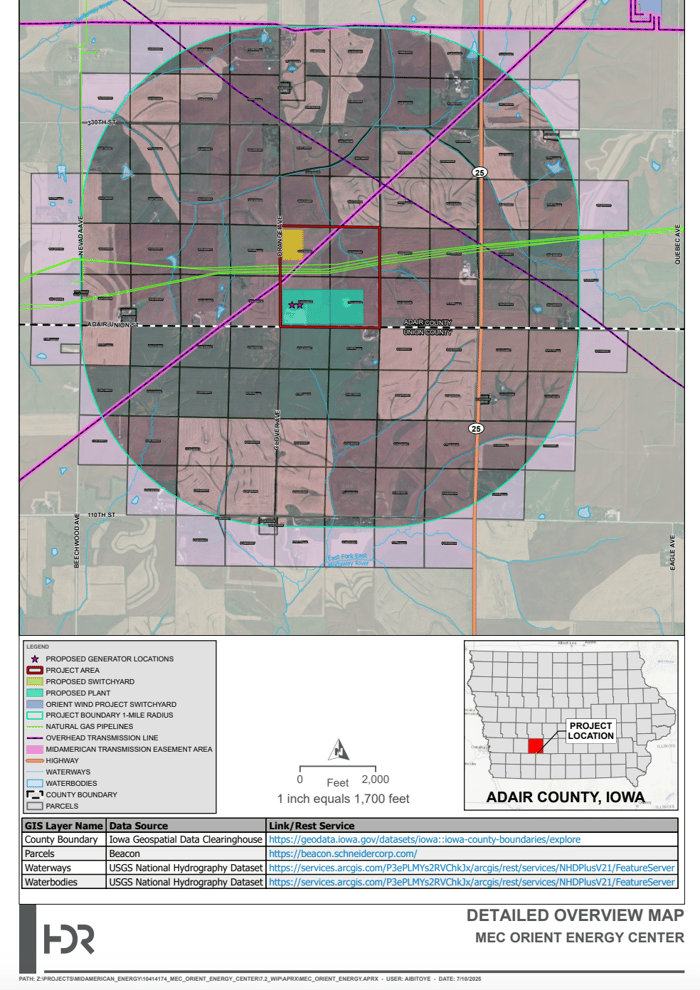

In Iowa, MidAmerican Energy Company has filed a Project Map for proposed “Orient Energy Center” project in Adair County. The Company is proposing to build two gas combustion turbines with 465 MW of combined capacity, a 365 kV transmission line, and a substation. The Company owns much of the necessary land and easements to build the project, as well as the natural gas pipelines that traverse the area.

MidAmerican’s high-level parcel map clearly color codes the existing infrastructure and the proposed project area.

__

And a New England bonus: Eversource in New Hampshire says to ISO New England that it must replace wooden poles for two transmission lines due to “woodpecker damage, pole top rot, pole top splits, checking through insulator/equipment connections, and other forms of decay.”

Also, the average age of its single-circuit H-frame wood poles is 62-63 years.

Line T198

.png?width=964&height=216&name=NH_ISONE_Eversource_T198_Structure_Count%20(3).png)

.png?width=1184&height=360&name=NH_ISONE_Eversource_Line_T198%20(1).png)

.png?width=1674&height=766&name=NH_ISONE_Eversource_Line_T198_Defects%20(1).png)

Line S153

.png?width=1152&height=338&name=NH_ISONE_Eversource_Line_S153%20(1).png)

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)