What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Subscribe below to get these insights delivered straight to your inbox:

What's Happening in Energy — Oct 24

Powered by Halcyon

__

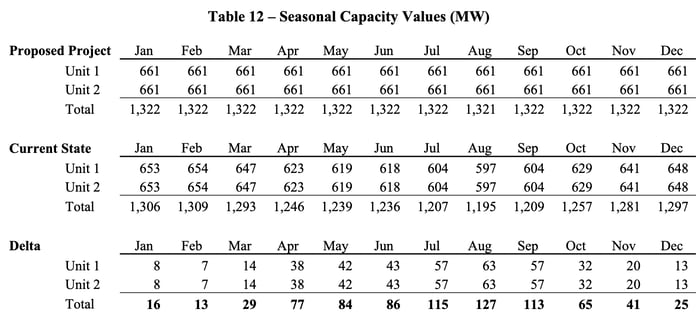

In Wisconsin, Wisconsin Electric Power Company has applied for authorization to upgrade gas combustion turbines at its Port Washington Generating Station (PWGS) to reduce capacity derates and achieve higher capacity factors. The utility’s extensive need and economic analysis concluded:

“Overall, across all the scenarios and sensitivities performed, the average NPV savings compared to the Alternative is approximately $300 million. Only in the Enhanced Carbon Reduction future (Future 4) does the proposed Project not show an economic benefit. However, that future assumes more solar facilities are available to be built in 2029 than the base assumption build limits in the PLEXOS model. Absent this change in the amount of solar available by 2029, all model comparisons show positive NPV benefits for the proposed Project. This demonstrates that over a wide array of assumptions the proposed provides Wisconsin Electric customers significant economic benefits.”

The project’s total estimated cost is $227 million, with $110 million allocated for Unit 1 and $117 for Unit 2, respectively. The upgrades will significantly increase the summer capacity by adding 127 MWs in August.

Dig into the heavily redacted yet still insightful analysis below.

__

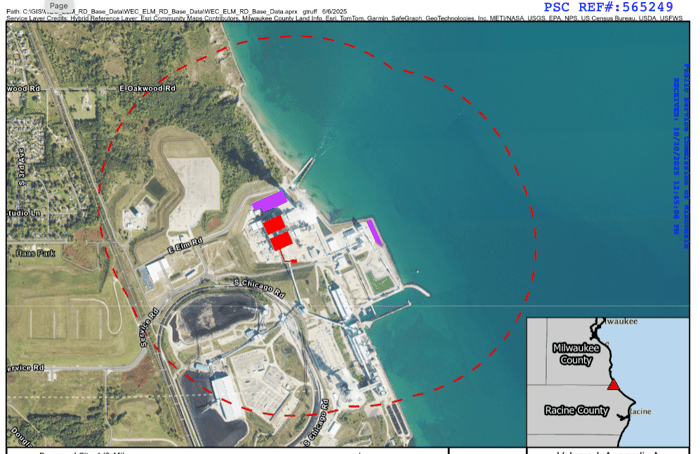

Also in Wisconsin, a joint application has been submitted by Wisconsin Electric Power Company (again!), Madison Gas and Electric Company, and WPPI Energy to obtain the Authority to Construct the Elm Road Generating Station (ERGS) Gas Fuel Flexibility Project in the City of Oak Creek, Wisconsin. The project aims to incorporate natural-gas firing capability to the ERGS, providing fuel flexibility (gas) while maintaining the existing coal operations and ash handling systems. An image of the site is provided below.

Notably, although this application has no new onsite storage, it refers to PSC’s recent final decision in docket 6630‑CG‑140, which approved Certificate of Authority (CA) to construct an LNG storage tank. Additionally, the CA application for the Rochester lateral (docket 6630‑CG‑139), scheduled for April 2024, is necessary to ensure firm gas supply.

- Docket profile

- Application to modify Elm Road Generating Station units for gas firing (fuel‑flexibility)

- Location map and aerials

__

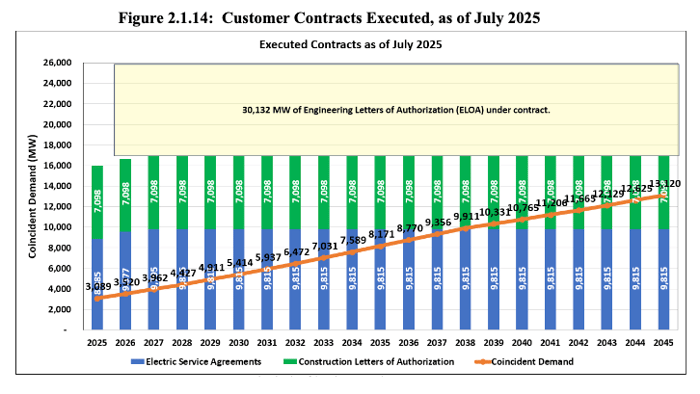

In North Carolina, Dominion Energy North Carolina’s 2025 update to its 2024 Integrated Resource Plan (IRP) includes customer contracts executed as of July 2025, which are categorized into:

- Engineering Letters of Authorization (ELOA),

- Construction Letters of Authorization (CLOA), and

- Electric Service Agreements (ESA).

As a customer progresses from (i) to (iii), their financial commitment and obligation increase. The graph illustrates a steady growth in executed ESAs through 2038, with CLOAs showing continued expansion beyond that year. For comparison with July 2024 figures, please refer to pages 28 and 115 of the 2024 IRP. For additional details on the three types of contracts, see Appendix 2A, section III.

__

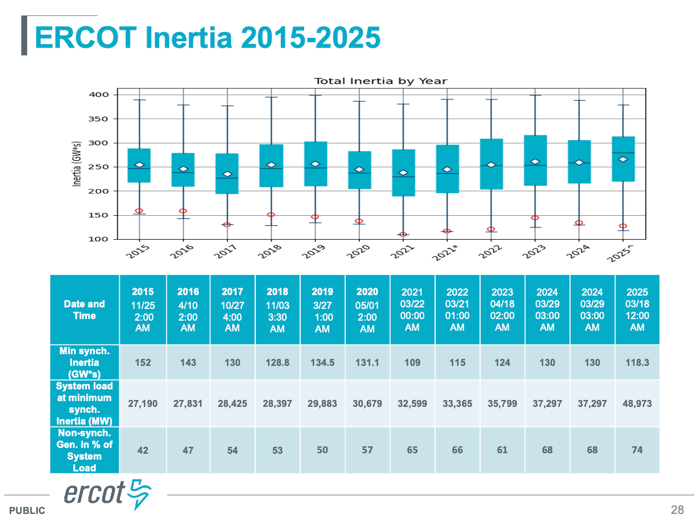

In ERCOT, the September 2025 Frequency Control Report provides a wealth of visuals illustrating the evolution in the percentage of renewables and system inertia.

Non-synchronous generation (i.e. inverter-based resources like wind, solar) as a percentage of load has increased steadily since 2015. The minimum system inertia, measured in gigawatt-seconds (GW*s), decreased from 2015 to 2020, reaching an all-time low of 109 GW*s on March 22, 2021. The table included in the report summarizes the lowest inertia recording for each year.

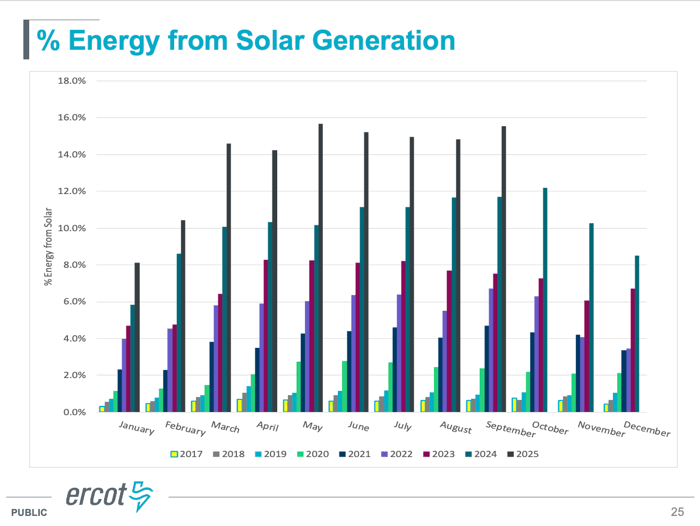

The percentage of energy from solar generation has increased significantly since 2017. In September, solar reached 15.55% of total generation.

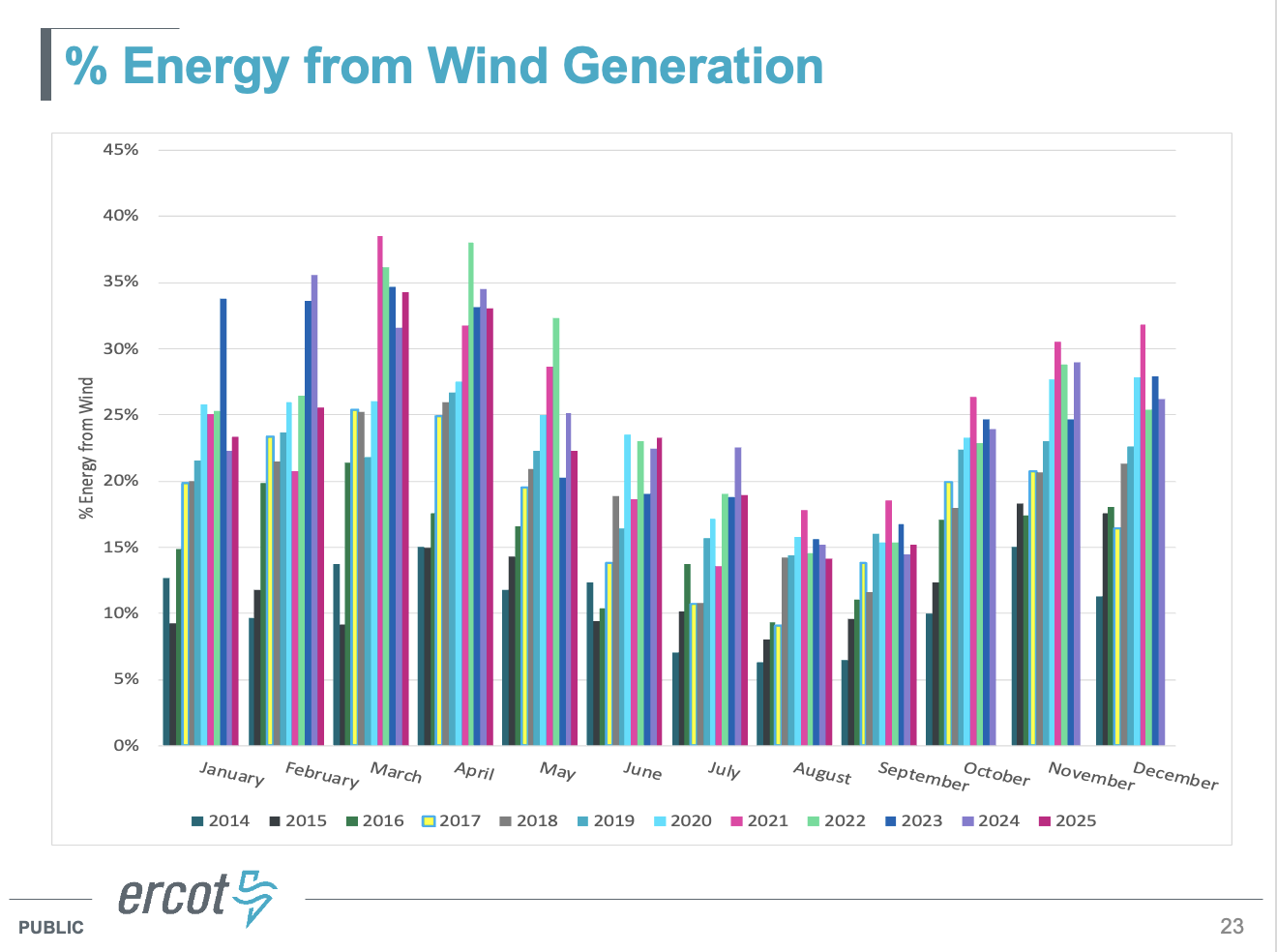

The story for wind generation is different. Although the percentage of total energy from wind is higher in absolute terms, the monthly percentage contribution to total energy generation has not seen as much of an increase as that from solar.

____

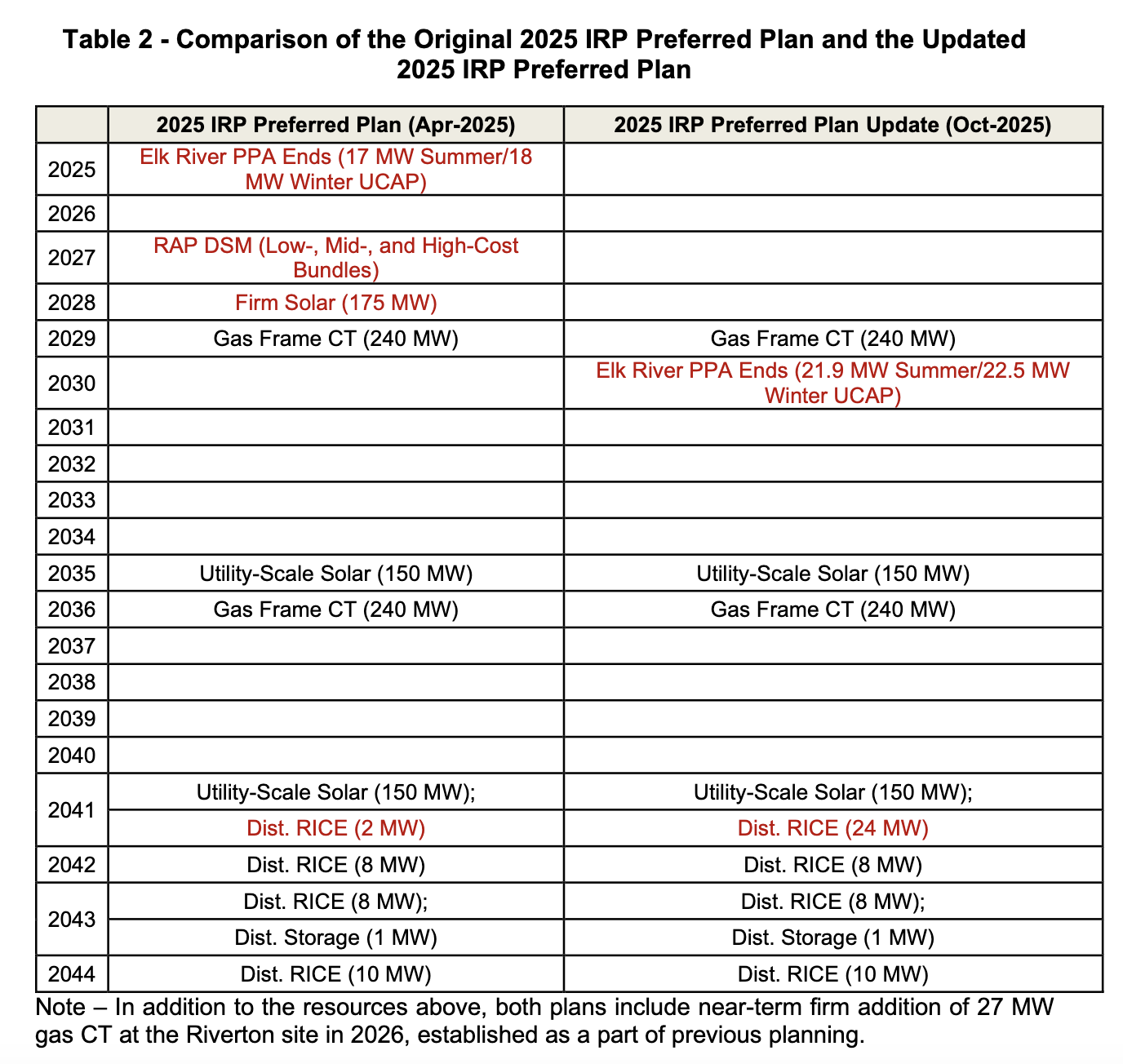

In Missouri, Empire District Electric Company d/b/a Liberty (Liberty-Empire) filed a Notice of Change to its 2025 Preferred Plan IRP. The main changes are as follows:

- Removal of a greenfield 175 MW utility-scale solar PV facility.

- Discontinuation of the utilities’ demand-side management (DSM) programs.

- Extension of the existing Elk River Wind Farm PPA to 2030.

- Procurement of 22 extra MWs of Distributed Reciprocating Internal Combustion Engine (RICE) in 2041.

The utility explained that Southwest Power Pool’s (SPP) new methodology for determining resource capacity contribution to summer and winter Planning Reserve Margins was a major factor in its decision to discontinue the 175 MW solar project. Earlier this year, The DSM program effectively ended following a settlement agreement between Liberty and stakeholders, after the Commission raised concerns that the DSM program did not align with the intent of the Missouri Energy Efficiency Investment Act (MEEIA). The marginal capacity contribution of RICE in the 2040s compensates for these lost resources.

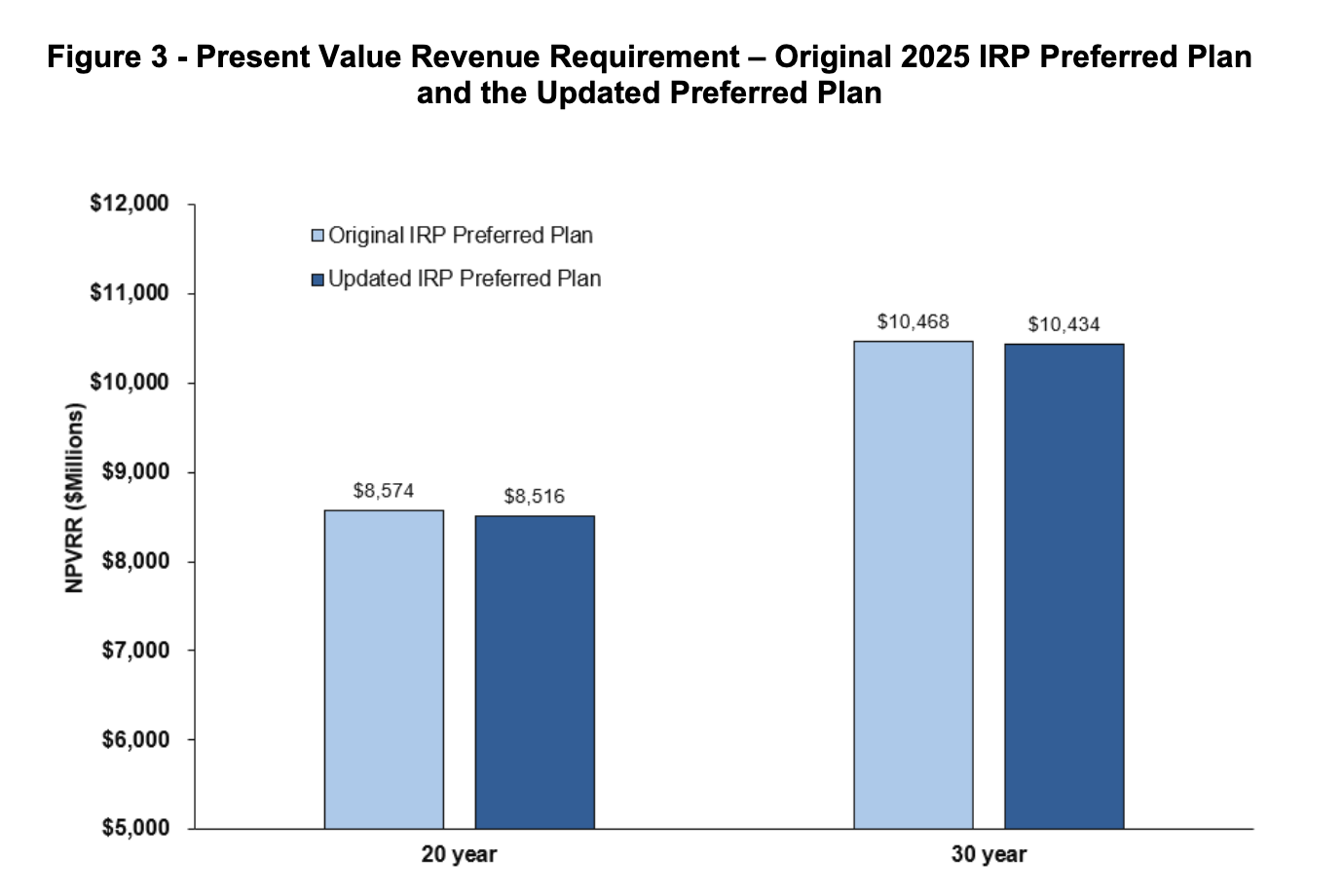

Liberty-Empire provided a chart to support its assertion that the update to its Preferred Plan would result in a lower Present Value of Revenue Requirement.

____

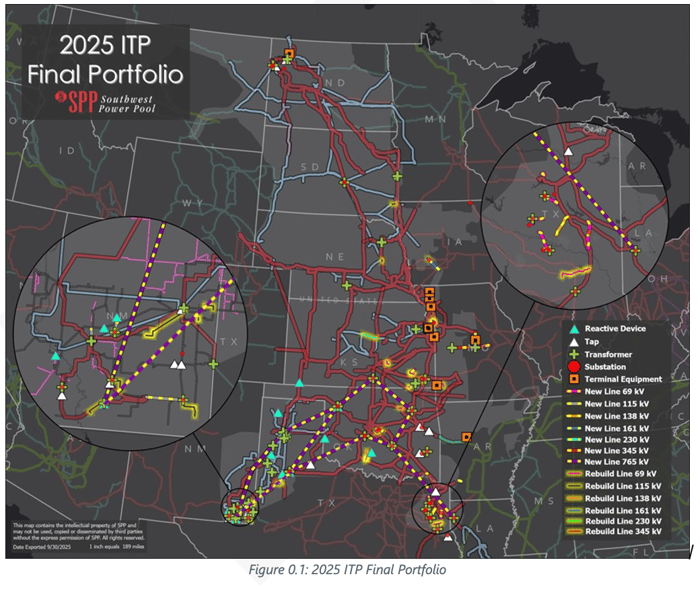

In SPP, the 2025 Integrated Transmission Planning (ITP) assessment is nearing completion. SPP has released a revised version of the 2025 ITP that incorporates stakeholder feedback. The final portfolio includes an extensive buildout of 765 kV lines, which the SPP deemed more cost effective than expanding 365 kV lines.

“Just as cities build new interstate corridors to support population growth, SPP must expand its 765 kV network now to meet the unprecedented magnitude and pace of load growth being observed, regionally and nationally; growth that is both regionally widespread and nationally significant. The network recommended in the 2025 ITP portfolio is a combination of ten 765 kV lines (with one being a double circuit). To achieve equivalent energy transfers with the current construct, almost 50 345 kV lines with a cost of $37 billion would be necessary. This would cost approximately 2.5 times more than creating a 765 kV system.”

The portfolio consists of the following projects:

- 2,530 miles of new high voltage (HV) transmission

- 1,871 miles of new EHV 765 kV transmission

- 498 miles of new EHV 345 kV transmission

- 344 miles of rebuilt HV transmission infrastructure

The assessment found that the Benefit/Cost ratio of this final portfolio would range from 5.70 to 9.36 under a Future 1 (69 GW peak) and Future 2 (80 GW peak) scenario, respectively, with both breaking even in 2029.

-2.png?width=700&height=409&name=unnamed%20(1)-2.png)

____

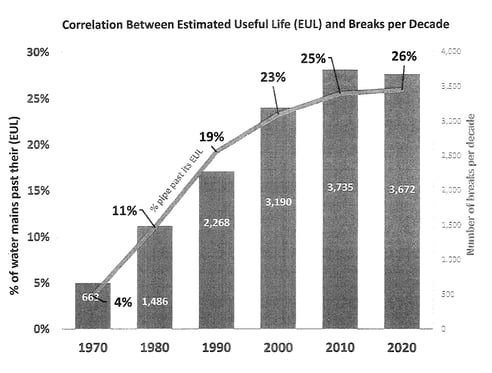

In Indiana, the City of Fort Worth municipal water utility is seeking to adjust its rates and issue long-term debt to better recover its expenses and fund “necessary extensions, replacements, and improvements to its waterworks system.” The proposal includes three rate increases of approximately 5% each, which will have varying effects on different customer classes: “The overall rate adjustment for each of Fort Wayne's rate classes will range from a decrease of 9.78% for one rate class to an increase of 5.73% for another rate class in a single phase.”

Additionally, the utility is requesting that certain data regarding large industrial water users — specifically GM and a data center — be kept confidential.

“In particular, the Confidential Information includes customer-specific monthly usage data (“Usage Data”) of General Motors, a multinational automotive manufacturer ("GM") and a global technology company's data center ("Data Center"), (together referred to as the "Large Volume Customers") contained in Fort Wayne's testimony, revenue requirements model, and cost of service study.”

The utility justified its request: “...the Confidential Information would be of economic value to suppliers and competitors of the Large Volume Customers and is not available or ascertainable by competitors through normal or proper means.”

Among hundreds of pages of exhibits, the utility provides a historical overview of water main breaks across its system (represented by bars in chart below) and the percentage of water mains exceeding their Estimated Useful Life (shown by the line in chart below).

- Docket Profile

- Utility request for approval to issue debt

- Utility request for confidentiality

- Testimony with infrastructure charts (pages 191-197)

__

In Georgia, Georgia Power has responded to data requests from the Public Service Commission regarding BESS projects. While these data requests are part of the 2019 IRP proceeding, the utility’s responses have a particularly 2025 flavor. In its update about the “Form Energy Battery Project,” Georgia Power mentioned that it is collaborating with “large load customers” to secure funding for the project:

“The Company is currently performing development activities to establish engineering and project cost estimates that are necessary to advance the Form Energy Battery Project in a way that maximizes value to customers. Additionally, the Company is evaluating innovative funding pathways, including co-investment from large load customers, to support investing in breakthrough decarbonization technologies while preserving affordability. The Company intends to submit the project for GPSC approval once these development activities are complete.”

__

In Virginia, Theresa Ghiorzi provided direct testimony regarding her concerns about the growth of data centers in Loudoun County and specifically addressed Dominion’s request for approval of electric transmission (Golden–Mars project: new 500 kV and 230 kV lines). Her request:

“A solution that provides balance between high load customers and private residential property owners would be one that provides service without sacrificing one group to the benefit of the other. All property owners must be treated equally minimizing the "collateral impact" is not equal. The only solution that treats property owners equally and resolves the health and environment concerns of residents is underground High-Voltage Direct Current (HVDC) on existing right-of-ways.”

And check out the visual referenced in her testimony.

-4.png?width=356&height=444&name=unnamed%20(2)-4.png)

__

FERC held two technical conferences this week. First was the Commission-led Annual Reliability Technical Conference (filings available via this Halcyon Search). Notably, MISO (Midcontinent Independent System Operator) presented remarks on its Expedited Project Review (EPR) process, which accelerates the review of transmission projects to accommodate large load additions. MISO reported a whopping 203% increase in load compared to last year, along with a remarkable 381% increase in related investment (see Table 1 below).

-2.png?width=688&height=306&name=unnamed%20(3)-2.png)

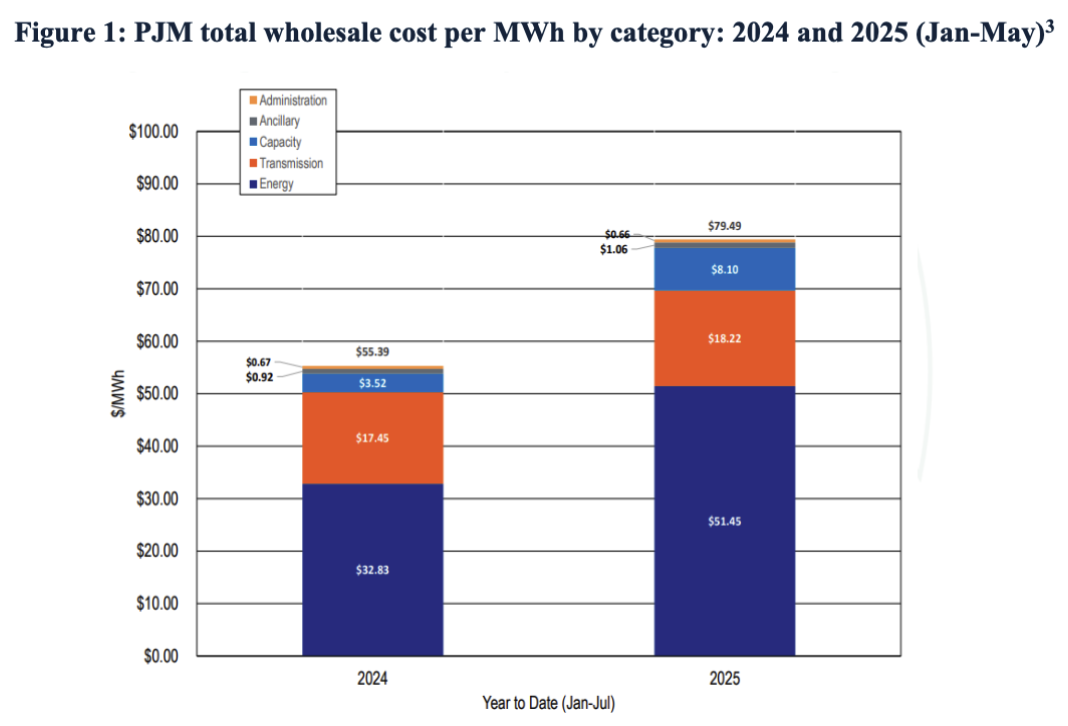

Exelon/ComEd included several recommendations, with some focus on PJM’s capacity market (see Figure 1 below). The light blue area shows a 130% increase in capacity prices compared to last year. Exelon/ComEd stressed the importance of PJM stakeholders considering more substantive capacity market reforms noting, “that a $30 billion (plus) auction is simply not sustainable for customers and regulators.”

You can view other comments from AEP, Duke Energy, NERC, and other comments regarding coming into FERC on Reliability through this Halcyon Search.

The second Technical Conference on the Wildfire Risk Mitigation (agenda) featured comments and presentations from PG&E, PNNL, Quanta Technology, and Chair Tawney of the Oregon commission. The discussion brought mathematics to the table – focusing on an equation that narrows in on risk spend efficiency. The aim is to develop metrics that quantify the cost per unit delivered and the reduction in risk after mitigation projects.

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)