What's Happening in Energy highlights the most interesting findings from public utility commission filings.

What's Happening in Energy highlights the most interesting findings from public utility commission filings.

Hey there, it's Nat –

New Data Subscriptions! Join the waitlist!

Remember, you can view the documents linked herein, but you must authenticate with a code sent to your email address (and sometimes in spam).

Subscribe below to get these insights delivered straight to your inbox:

What's Happening in Energy — Dec 12

Powered by Halcyon

____

In Michigan, the Attorney General (AG) responded to DTE’s request to bypass a contested proceeding for its special contract with a 1.4 gigawatt (GW) large load customer. DTE argued that a contested case would delay procurement of the storage needed for the customer’s load ramp. The AG, however, raised concerns about several contract terms–including the minimum billing demand charge, termination fee, and projected resource needs–and argued that DTE did not adequately justify the amount of capacity investment proposed:

DTE’s application also presents an unclear range as to how much renewable generation … to accommodate the customer, stating that “incremental renewable energy capacity required to meet the increased RPS could technically reach up to 3.2 GW, but may be as low as 443 MW by 2032…” The difference … in generation development costs could be well in the hundreds of millions, if not billions of dollars.

Dig into the AG’s filing below.

____

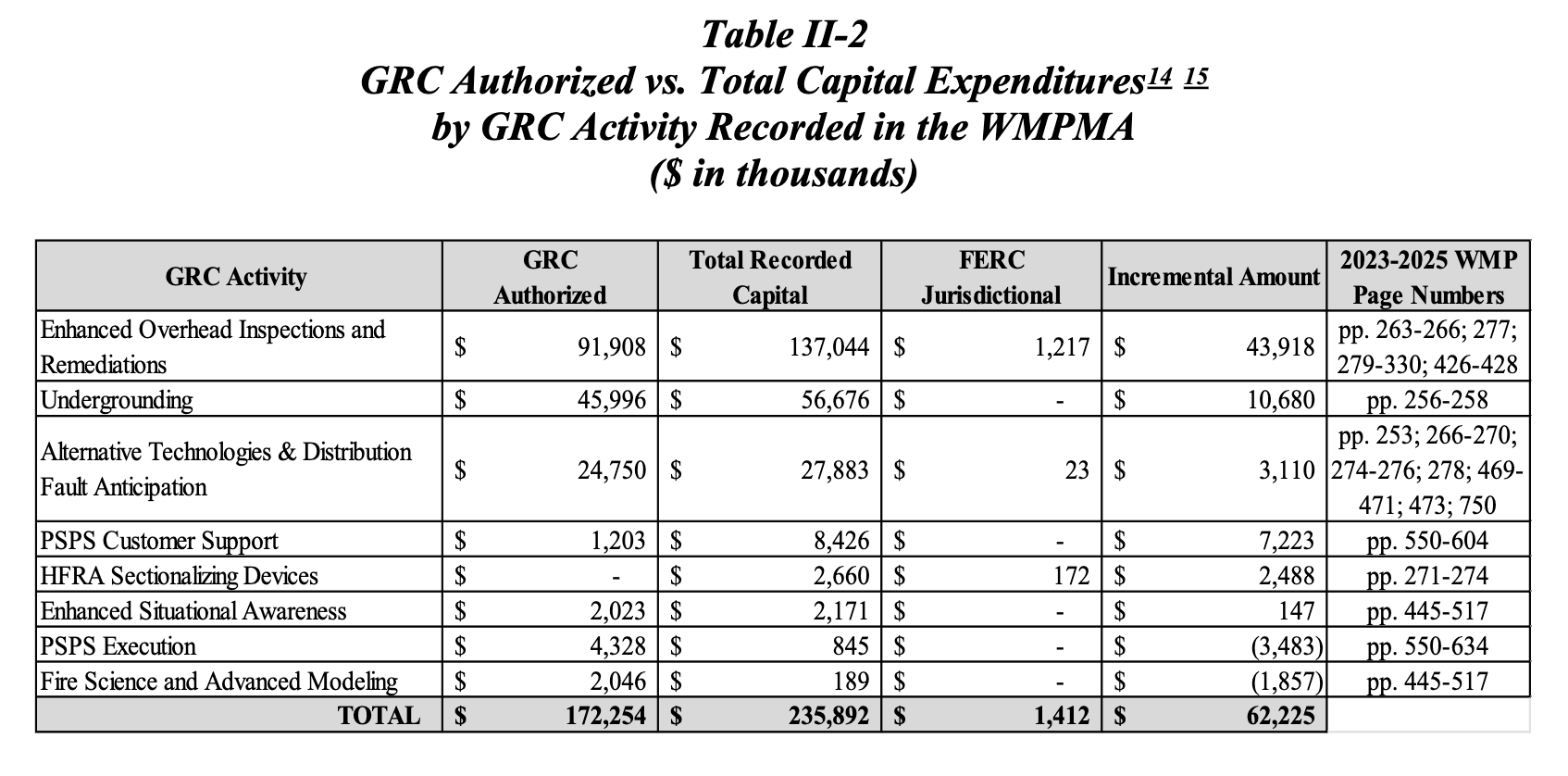

In California, Southern California Edison (SCE) is seeking recovery for approximately $62 million of incremental capital and $48 million of O&M expenditures for its Wildfire Mitigation Plan (WMP), above the amounts approved in the 2021 General Rate Case (GRC). The Commission has approved similar requests in prior years. For 2024, the utility noted that the exceedances stem from how the original GRC-authorized amounts were imputed from 2021 spending, and justified the expenditures as necessary: “this level of spending was needed to protect public safety, adhere to statutes and regulatory requirements, and comply with SCE’s approved WMP commitments.”

Curious to dig in more about how SCE’s accounting methods contributed to the exceedances? This is a great example of the kind of use case Halcyon was built for. The filing is a dense, word-salad of utility regulatory and rate-making jargon. Try this Halcyon Query.

____

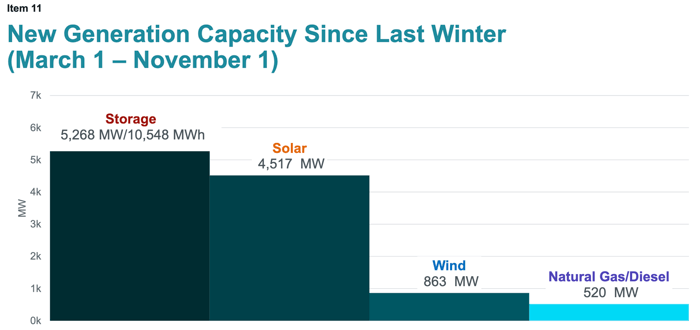

In ERCOT, CEO Pablo Vegas shared an update at the Board of Directors meeting that included a bar chart showing roughly 11 GW of new generation added since last winter.

The visual included a caveat: “Note that energy storage (batteries) has limited-duration run time, so the available energy during periods when they are most needed—the highest demand hours, which typically occur early morning pre-sunrise, and evening during and immediately after sunset—depends on the extent that they can be recharged prior to those periods.”

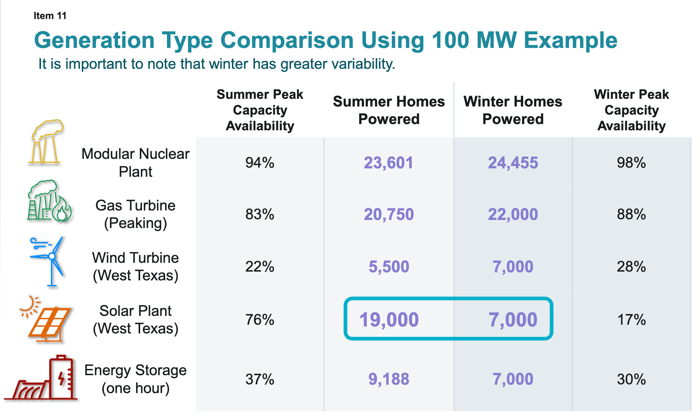

The next slide presents a side-by-side comparison of each resource’s capacity contribution in the summer versus winter. Every resource shows a higher winter contribution except the two with the largest recent additions: solar + storage.

____

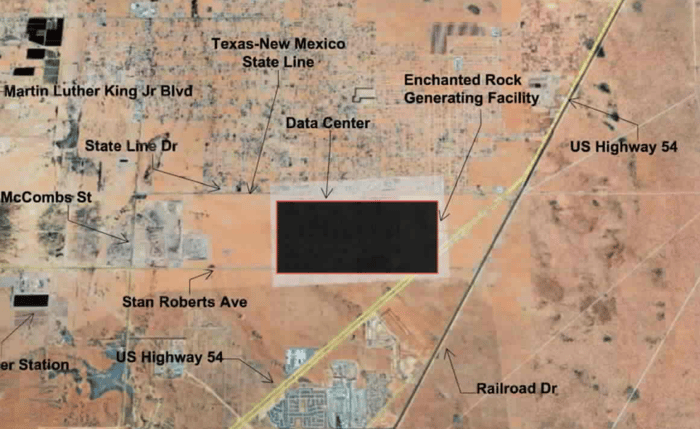

Also in Texas, El Paso Electric (EPE) is seeking approval to amend its Certificate of Convenience and Necessity (CCN) to add the 366-MW McCloud natural-gas facility. The site is adjacent to the Wurldwide (Meta) data center. During a 2027 ‘bridge period’—lasting up to five years—the plant would serve the Meta data center before eventually connecting to EPE’s transmission system.

Wurldwide’s original load ramp was estimated at ~220 MW. The company has since signaled a much larger buildout: up to 440 MW by 2027 and potentially 1 gigawatts (GW) by 2029. To meet this need, McCloud Generation will include 813 modular gas units (450 kW each), totaling 366 MW on a 31-acre site. Enchanted Rock will build and operate the facility under contract with EPE, supplying the data center with a steady 225 MW at a 95% load factor.

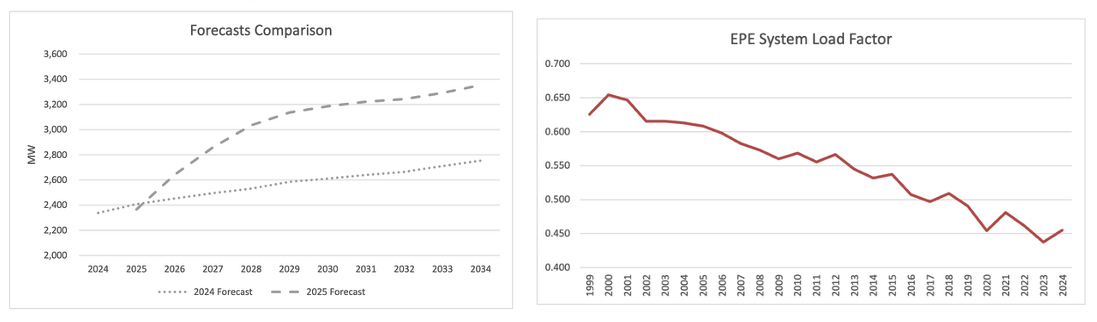

And speaking of load growth and load factor, EPE’s 2025 Forecast shows a sharp shift from its 2024 Forecast. While the 2025 peak estimate is slightly lower for the near term, projected peak demand jumps significantly in subsequent years–189 MW higher than the 2024 Forecast by 2026 and widening to 600 MW by 2034. The figure on the left illustrates the growing gap between the two forecasts. And on the right, EPE highlights its expected rebound in system load factor. Several factors have pushed EPE’s system load factor downward, but the utility expects this trend to reverse. By 2044, EPE projects a native load factor of 0.537–and increases of 23% from its 2023 low of 0.438.

____

In Iowa, the Commission approved Interstate Power & Light’s (IPL) certificate of public convenience, use, and necessity (CPCN) to build the 750 megawatt (MW) Bobcat Energy Center, a simple-cycle gas plant in Marshall County. The approval included waivers such as skipping a public hearing, which IPL said could jeopardize meeting its planned in-service date Q3 of 2029. The plant is expected to run 500 to 2,000 hours per year, “most often during the afternoon, especially during the high-load summer months, with additional use during evening and overnight hours as solar and battery capabilities diminish.”

____

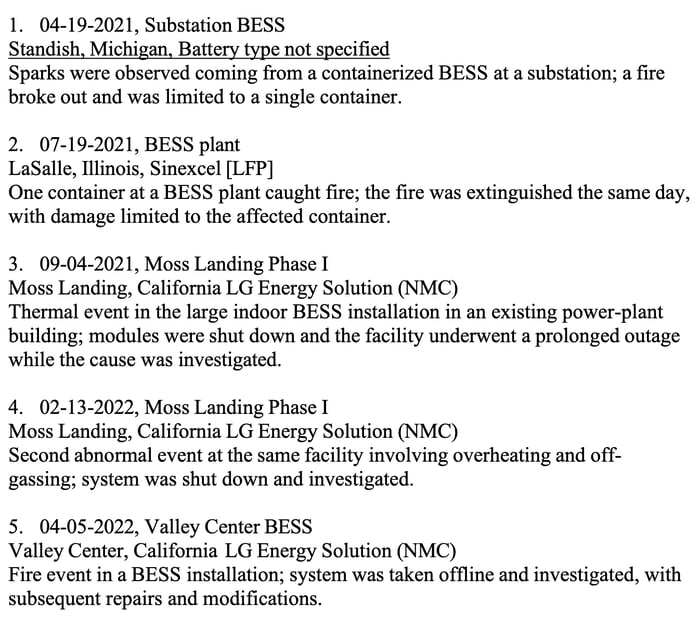

Coming in hot from Massachusetts–but covering the U.S.--a list of Battery Energy Storage System (BESS) emergency thermal events over the past 5 years. Below are the top five of the 25 incidents. Most occurred at non‑residential, utility‑scale systems and were typically contained within a single enclosure using defensive/monitor‑and‑contain tactics.

Halcyon just released a BESS tracker, click here for more details.

____

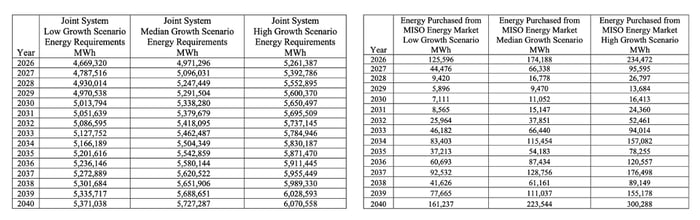

In Minnesota, Minnkota Power Cooperative and Northern Municipal Power Agency jointly filed their 2025 Integrated Resource Plan (IRP). The IRP paints a picture reminiscent of many utilities at the moment–balancing sudden load growth with concerns regarding resource adequacy and (MISO?) affordability.

The IRP included charts showing the projected annual share of energy requirements procured from the MISO wholesale market. Annual purchases from MISO remain under 5% through 2040 (see below). This, according to the IRP, is by design, “A financial risk exists in depending too greatly on the MISO capacity and energy markets, since the MISO market can be extremely volatile and expensive at times. Also, delivery of market power can be an issue…. the Joint System prefers to fulfill as much of its energy requirements as practical from generating resources it owns or has agreements to purchase the output at fixed prices.”

Another section of the IRP noted rising interest cooperatives are seeing from large loads. Minnkota already has a wholesale rate class for them, and a 280-MW data center coming online in 2026 will take service under its data center tariff. According to the IRP, “Applied Digital … a $3 billion artificial intelligence (AI) data center near Harwood, N.D…. is scheduled to begin operations in 2026 and reach full capacity by early 2027…. the facility will be the largest single load interconnected to the cooperative’s system.”

____

In Montana, NorthWestern Energy was granted a protective order after a series of large load announcements:

Dec 17, 2024 – NorthWestern announced plans to supply a 50 MW data center from 2027, with potential growth above 250 MW by 2029.

Dec 19, 2024 – NorthWestern announced it will supply a 75 MW data center in Butte starting in 2026, with possible additional 75 MW over the next 3–5 years.

Jul 30, 2025 – NorthWestern signed a letter of intent with Quantica Infrastructure for a Montana data center, targeting service from 2026, up to 500 MW by 2030, and possibly 1 GW later.

Feb 11, 2025 – The Commission requested NorthWestern’s interpretation of Mont. Code Ann. § 69-8-201(1) in light of the new load commitments.

Mar 4, 2025 – NorthWestern responded that Montana law does not require Commission approval for supplying new large-load customers.

Sep 3, 2025 – The Commission issued a Request for Information seeking all LOIs, MOUs, agreements or contracts related to the announced data-center loads.

Sep 17, 2025 – NorthWestern filed a Motion for Protective Order to shield three of the LOIs from public disclosure.

NorthWestern states, ”that while it intends to present the final agreements for Commission approval, it still anticipates that certain contractual terms in the final agreements will need to remain confidential to ensure protection for their customers and the specific rates and charges they may pay for service from.”

__

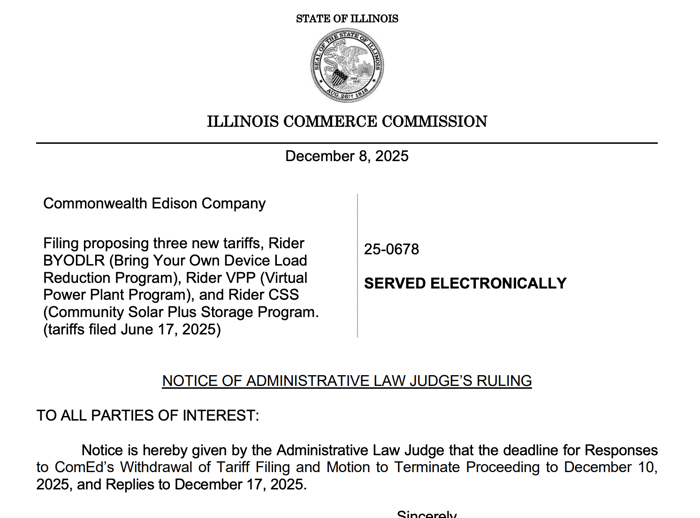

In Illinois, in case you missed it, ComEd made a withdrawal—no, not a load withdrawal–but made a request to pull its Tariff Filing and filed a Motion to Terminate Proceeding. The filing had proposed three new tariffs, Rider BYODLR (Bring Your Own Device Load Reduction Program), Rider VPP (Virtual Power Plant Program), and Rider CSS (Community Solar Plus Storage Program.)

__

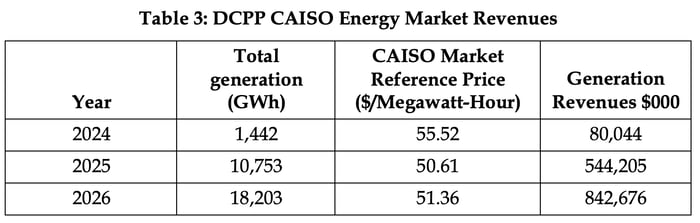

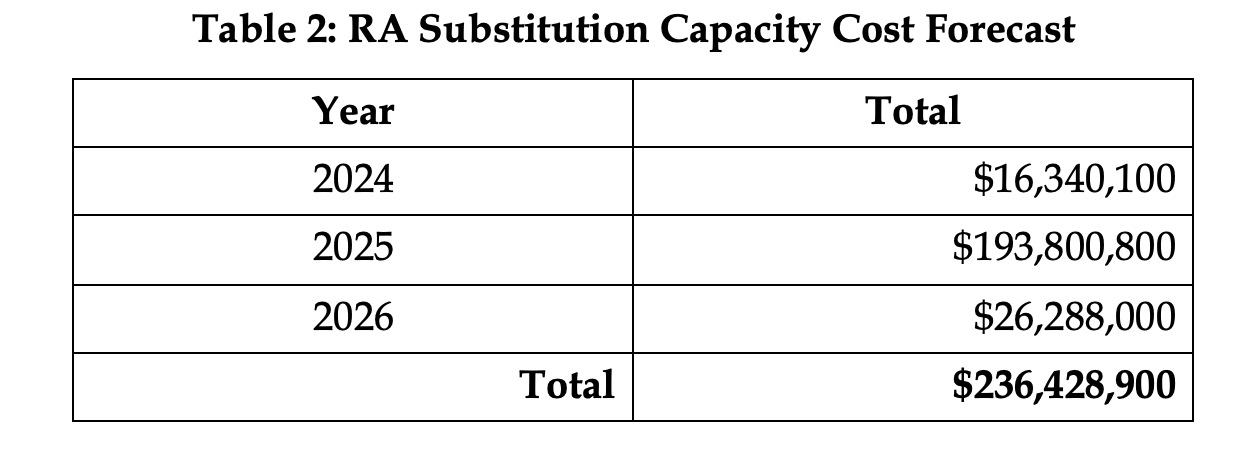

In California, the Public Utility Commission (CPUC) approved PG&E’s rate update beginning January 2026 to recover costs tied to extending operations at the Diablo Canyon Power Plant (DCPP) through 2026. The update follows Senate Bill (SB) 846 (2022), which authorized extending DCPP’s operations through 2030. PG&E sought $1.2 billion in costs, offset by $843 million in CAISO market revenues, for a net revenue requirement of $382 million.

One of the cost line items is for “RA Substitution Capacity,” which projects the costs of sourcing replacement capacity based on outage and maintenance schedules. In 2026, the cost for this substitution capacity declined by over $160 million relative to 2025, driven by lower Market Price Benchmark (MPB) and an updated outage schedule. The updated MPB for 2026 is $11.53 relative to $42.54 for 2025.

.png?width=50&name=34C0AE28-DE08-4066-A0A0-4EE54E5C1C9D_1_201_a%20(1).png)